Stock Market Wealth

Become A Wealth Machine

Wealth Monsters – A Rare Breed of Companies

In Part 1, the idea we explored was the amazing simplicity of owning a truly global business today and why investing in the bright prospects of the global economy will reap generous rewards for those shareholders who have the stamina and resolve to own stocks on a long-term basis. Those investors always make big money with the Wealth Monsters. The reason is simple: this tiny group of unique companies keeps on advancing by trimming costs, expanding margins, liquidating unprofitable ideas, growing the high-margin products, and relying on brand power and scale.

In Part 1, the idea we explored was the amazing simplicity of owning a truly global business today and why investing in the bright prospects of the global economy will reap generous rewards for those shareholders who have the stamina and resolve to own stocks on a long-term basis. Those investors always make big money with the Wealth Monsters. The reason is simple: this tiny group of unique companies keeps on advancing by trimming costs, expanding margins, liquidating unprofitable ideas, growing the high-margin products, and relying on brand power and scale.

A Wealth Monster goes through three main stages:

- Market Penetration.

- Rapid Growth.

- High Profitability.

In practically every business school, this is the chart that represents how companies evolve. This is true for most of the businesses in the world, but not Wealth Monsters. What they thrive at is avoiding the 4th stage. How?

Keeping a state of mind of a company in growth mode is the key. These companies don’t allow themselves to mature. The management and board keep on challenging the strategic levels with new ways of satisfying customers and keeping them loyal. Every company wants that, but how do these particular ones succeed?

A Wealth Monster is a company destined for greatness. What makes it special first of all is:

Brand Power

These companies, along with the other 75 companies on the list, are able to charge more for their services – their margins are better and stability is larger. Coca-Cola basically sells sugar-water with gas for a price higher than gasoline.

Addictive Products

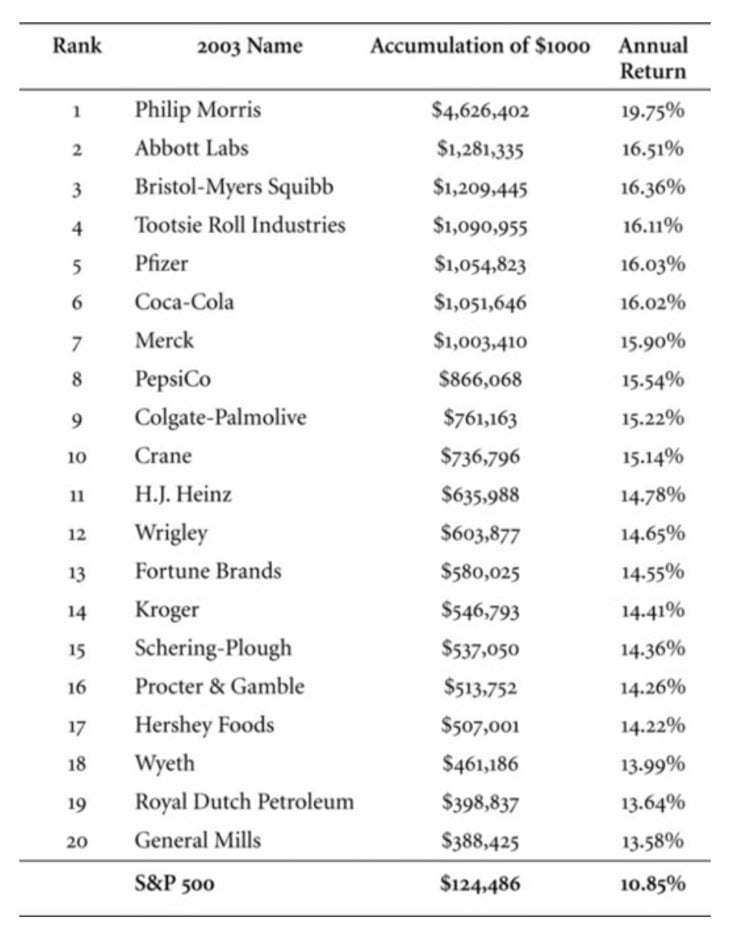

To truly be a Wealth Machine, what you are selling can’t be a fad. It must be a product that has a repetitive use by the customer. I can think of no better examples than alcohol, cigarettes, and search engines. What I am about to share with you are the top 20 best-performing companies between 1957-2003. You will easily notice that these aren’t technology companies with breakthrough products, but rather household names that sell basic stuff.

Any Marlboro smoker could have put 2 and 2 together and instead of buying 5 packs a week, they could settle on four packs and invest the rest in Phillip Morris. By the time they were ready to retire, every $1,000 would be worth $4,626,402. Any parent could have invested In Tootsie Roll, any teen in Coca-Cola, any housewife or cleaning lady in Colgate-Palmolive, and any chocolate lover, and many of us are, could have bought Hershey’s shares instead of Hershey’s Kisses. These companies are Wealth Monsters, and you will notice Warren Buffett owns many of these stocks, and he recently bought and merged Heinz and Kraft Foods. The lesson to be learned here is that companies that can fund your retirement aren’t hidden away from you in some garage where two kids are working on YouTube. That deal is never going to make you rich, because by the time it goes public, the venture capitalists, founders, brokers, investment banks, lawyers, and any other professionals who could have taken some of the table have done so.

Shareholder-Friendly Management Culture

This is the glue that sticks all the various components together in a Wealth Machine. When management allocates capital efficiently, the company can absolutely flourish. There are four ways to use shareholder money:

- Invest in the business: New machinery, better employee pay, expansion, and more.

- Acquire other firms: This is a way of growing by strategically finding companies that will add value immediately. This is very tricky and requires very skilled people.

- Purchase your own stock: One of the best ways of adding value is by reducing the share count. If done right, when the company’s price is lower than the historic 10 P/E ratio, the company should buy stocks back. This increase grants the existing shareholders a bigger piece of the pie without added tax on their larger share position.

- Dividends: A true sign of a disciplined management and a powerful company is a steady and growing dividend stream coupled with a reasonable payout ratio. This leaves room for further increases. In the top 20 list of the best-performing companies, you will notice Phillip Morris and Abbott Labs at the top. These two firms have been increasing their annual dividends as a matter of policy for decades. Think of owning a rental property that gushes increased rents every year. It is a Wealth Machine!

The Secret Sauce

What is described above is the recipe for a wonderful business. There are many wonderful companies out there; at least 1,000 firms deserve a closer look.

When I looked for a vacation spot online a number of weeks ago, I found that the Maldives are an exquisite group of islands in the middle of the Indian Ocean. The beaches are white and the water crystal clear. The weather is incredible and the hotels are built on the water. This is, no doubt, a gorgeous place. The prices, though, were extremely high. That’s because in the last few years, many celebrities have taken pictures there, and this has promoted the Maldives as a summer vacation for winter time – a tropical paradise. When a wonderful thing is priced for a premium price, you are not getting a good deal, just a good thing.

In the stock market, many of the wonderful businesses are priced with high expectations. This isn’t an attractive situation for astute investors. We want to vacation in the Maldives when all the celebrities change their tune to Southern Italy or Thailand and prices come down again to lure tourists. What lures me to purchase a stock, and should lure you, are low expectations. The company that has compounded at the same rate as Warren Buffett’s BRK is Phillip Morris, at 19.75% per annum, as shown above. What’s the reason?

The company was climbing a wall of worry: lawsuits, fear of increased regulation, a scandal in the ‘80s, a health trend, and other headwinds signaled to investors the company is headed for a decline. This made it possible for astute investors, interested in the facts, the ability to buy more shares since prices were lower and collect more dividend income to then reinvest in the reasonably-priced shares. It’s a wonderful cycle.

This is what being a contrarian is about.

When you look for your next investment, start with the industries that are now hated and filled with worries. Look for companies that have these characteristics, and keep climbing the wall of worry into riches. It’s the secret sauce of all true investors.

Continued Reading

Silver’s Breakout Can’t be Tamed or STOPPEDThere's very little that I can think of that is more bullish to silver than …

Silver’s Breakout Can’t be Tamed or STOPPEDThere's very little that I can think of that is more bullish to silver than …

Cryptocurrencies Explode!Cryptocurrencies are the Future of Financial Technology and are becoming vital and have demonstrated tremendous …

Cryptocurrencies Explode!Cryptocurrencies are the Future of Financial Technology and are becoming vital and have demonstrated tremendous …

Debt Ceiling Chaos: We’ve Got Unfinished BusinessWho knows for how long, but there was a time, lasting perhaps centuries or more, …

Debt Ceiling Chaos: We’ve Got Unfinished BusinessWho knows for how long, but there was a time, lasting perhaps centuries or more, …