Stock Market Wealth

Become A Wealth Machine

Commodities ON SALE: Major News for All Investors!

Buying commodities stocks at low prices and selling them much higher is an art. When precious metals slump, I don’t view this as bad news; in fact, I celebrate! I go bargain shopping for the commodities stocks that I’ve been keeping on my watch list.

There really is no better time to scoop up shares of precious metals stocks than now. Commodities slumps don’t last forever and precious metals will always have value, just as they have had for thousands of years.

Just look at the numbers: we’ve got gold down to the mid-1200s, silver at the 16 level, platinum in the mid-800s and palladium in the mid-900s. These are prices we haven’t seen in a while and might not see again anytime soon.

Commodities stocks in general are a great way to diversify any portfolio. If you’re 100% in blue-chip stocks from the Dow, NASDAQ, or S&P, you’re headed for serious trouble when the market takes a dive.

I say “when” and not “if” because the major indexes run in cycles, and what comes up must, sooner or later go down.

There’s no question that holding some carefully selected commodities stocks is an ideal way to add some much-needed breadth to your long equities portfolio.

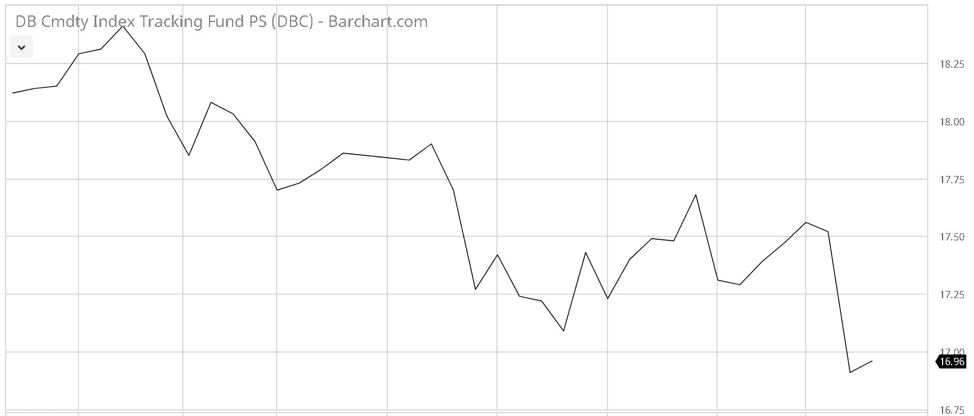

There really is no better time, as we’re at a point in the commodities market cycle when prices are extremely attractive. My team of experts has been watching for certain specific levels, and we’re hitting one of those levels right now:

Courtesy of barchart.com

The chart above shows you just how cheap commodities are in general, and I’ve been taking it a step further and zeroing in on the best commodities to buy now. So, which commodity am I focused on right now? Here’s something that might surprise you: the experts at Wealth Research Group have been looking very closely at copper lately.

The price of copper has dropped dramatically, and history shows that investors can’t go wrong at this level:

Courtesy of macrotrends.net

The preceding chart illustrates why I never buy at high prices: the $3.30 resistance level is super-strong and could be a great price target. But I’m not buying copper directly – I’ve been hunting for a company and a stock that will give me the best yield.

My research team and I have been looking for a company that’s been making waves in the headlines, and that’s exactly what I’ve found with Kutcho Copper Corp. (TSX-V:KC, OTC:KCCFF).

Kutcho Copper, a Canadian resource development company focused on expanding and developing the Kutcho high-grade copper-zinc project in northern British Columbia, just today made a huge splash in the news when it announced its launch of MineHub Technologies Inc.

MineHub is a cutting-edge technology company leveraging powerful blockchain technology to develop a new generation of applications for the metals and mining industry. The initial application to be released for MineHub will focus on supply chain and asset management to create a secure, traceable and streamlined journey of assets from the mine site to the smelter and beyond.

Leveraging the blockchain will propel Kutcho Copper, already a leading-edge mining firm, to new heights. Vince Sorace, President and CEO of Kutcho Copper, states: “MineHub presents a remarkable opportunity for Kutcho Copper shareholders to benefit from ownership in this groundbreaking technology which we believe can transform the mining industry… Working together, MineHub will be exposed to the vast knowledge and experience of the syndicate that will drive application development to become adopted and useable by industry as a whole.”

Add to this great news the fact that the stock shares are trading at their 52-week low:

Courtesy of Yahoo Finance

It’s a no-brainer: shares of Kutcho Copper are the best deal in the commodities space right now, bar none. I’m loading the boat and will continue to add to my position – take a look at Kutcho Copper stock today and you’ll agree that it’s a great addition to any portfolio.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Legal Notice: This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

I Submit to you my Next BIG MOVEAt the turn of the 20th century, a family of immigrants from eastern Europe lived …

I Submit to you my Next BIG MOVEAt the turn of the 20th century, a family of immigrants from eastern Europe lived …

Look at What Gold Just Did!This Week, Gold Flashed a Bullish Signal We Haven’t Seen in Over a Year. Paul …

Look at What Gold Just Did!This Week, Gold Flashed a Bullish Signal We Haven’t Seen in Over a Year. Paul …

DEATH WISH: Gold Shorts Get CRUCIFIED!Let's recap the Federal Reserve's policy for the past 10 years, as we transition into …

DEATH WISH: Gold Shorts Get CRUCIFIED!Let's recap the Federal Reserve's policy for the past 10 years, as we transition into …