Stock Market Wealth

Become A Wealth Machine

COMPLETE DISARRAY: JUMP SHIP NOW!

Today’s message is clear and critical: if you don’t have at least 12 months’ worth of living expenses in cold, hard cash or in physical precious metals, and you’re currently relying on a SOLE source of income to sustain your livelihood, your financial situation is UP IN THE AIR.

The coming recession is going to be radically different than anything we’ve ever encountered.

I’m going to show a number of crucial stats, and you need to do some serious thinking – immediately – because the clock is ticking.

For one, using the original way of measuring tightening cycles by discounting QE and QT shows that yields, in real terms, have been INVERTED for months already, which is a clear indicator of recessions!

Check this out:

Courtesy: Zerohedge.com

This chart shows that, according to the Federal Reserve itself, the likelihood of a slowdown is virtually assured.

The insane part about it is that in real terms, it’s as if the FED raised rates by 6.125% when they really only raised them by 2.25%. This means that when they need to cut them again, they will not HESITATE to go into negative territory, if need be.

Secondly, it means that cheap and unrestricted credit is more essential to the global economy than ever before. We’re dependent on this bubble to keep the musical chairs game going.

The ability of both the government and central banks to reassure the public of their (top officials’) decision-making capabilities, and that they’re working on BEHALF of the good of the general public is greatly diminished. Less than 20% of the people trust the government, wholeheartedly.

Put differently, if governments and banks don’t understand that they’re now being examined under a magnifying glass, they are blinded by their own conceit.

One bad decision, be it small or large, such as raising the tax on diesel fuel in France, led to the birth of the Yellow Vests movement and its vast web of rioters.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

Trust is the bedrock of modern life. Don’t ever forget that. We have been able to enjoy the spoils of 21st living in the western world because most people trust that the majority are genuinely good and will not screw them over.

Trust lubricates our system, but this trust is tested more now than ever before.

Courtesy: Zerohedge.com

We’re already in a slowdown – the stock market is not a reliable indicator of the financial conditions around the world.

Don’t look to it for guidance. It can continue rallying, disregarding fundamentals.

The near-term future outlook is bleak and your PRIMARY concern must be to be ready for the probability that, in the U.S. and in Europe, companies will be laying off employees, which will serve as a catalyst for additional companies to do the same.

Here’s the best way to think about it: when Walmart cuts a few thousand people from its payroll, its suppliers, vendors, and satellite businesses (which depend on Walmart’s strength for their own existence) will have to let go of some of their workforce as well.

I go back to my original message and warn you that millions of jobs are at risk, as it stands.

This is one of the reasons for the incredible gains we’ve been making with cryptocurrencies this year!

I absolutely love it. I also see that corporations are focusing their efforts to enter this sector by issuing “corporate coins.”

Starbucks, Facebook, and others are developing these with the idea that having a token that its clients/users can use for purchases creates a loyal customer base. The business can then get to know the customer better, in order to serve it professionally and more efficiently.

This is a HUGE trend and it will help drive prices down for essential items. Imagine having your favorite bookings website send you alerts whenever deep discounts are available with the destinations that you’ve indicated you’re looking to book, and you can instantly spend your tokens and book the trip.

The company you’re a client of becomes your personal watchdog.

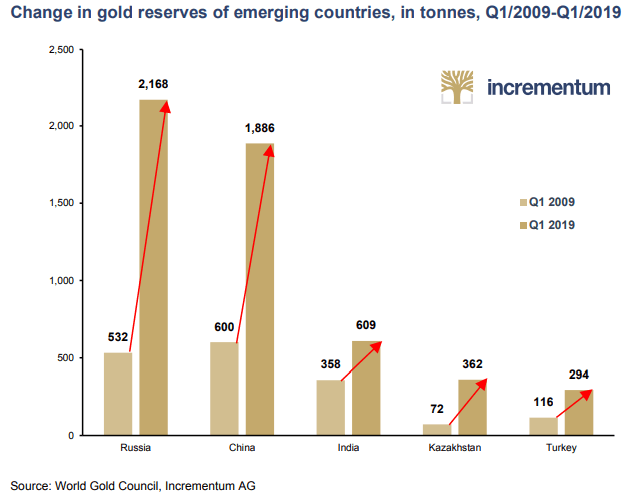

Distrust in the current financial system is evident, which is the reason central banks are HOARDING gold, as you can see:

So, governments are distrusting fiat currencies and converting dollars into precious metals.

However, companies like Starbucks, Walmart, Amazon, Google, and Coca-Cola won’t re-allocate cash into precious metals, but they’ll be VERY OPEN to floating their own tokens, serviced on a private blockchain.

Most will not take the long road of employing an in-house blockchain department. They’ll use a vendor, a specialist company that creates, develops, and maintains these digital structures.

Currently, there are only a few who can execute these types of projects and they’re mostly private companies.

I’m on the verge of sinking my teeth into the only one I’ve found that actually is a publicly-traded company, and it already has an impressive cliental rolodex.

Very soon, we will publish research on it that is groundbreaking; it is a situation that I’ve never encountered in my career – as close to a holy grail as it gets.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

WARFARE TACTICS: FED Orchestrating Cosmic BUBBLE!In the coming year, you will begin to notice how the mainstream media is changing …

WARFARE TACTICS: FED Orchestrating Cosmic BUBBLE!In the coming year, you will begin to notice how the mainstream media is changing …

2018 U.S. DOLLAR RALLY SHATTERS EXPECTATIONS!To the surprise of many, the U.S. dollar has been the best-performing asset of 2018 …

2018 U.S. DOLLAR RALLY SHATTERS EXPECTATIONS!To the surprise of many, the U.S. dollar has been the best-performing asset of 2018 …

CAPITALISM UNDER ATTACK: Craig Hemke Breaks Down the War on Free Enterprise in AmericaLarry Fink, Mark Zuckerberg, Ray Dalio, Warren Buffett, and Bill Gates are incredibly wealthy individuals …

CAPITALISM UNDER ATTACK: Craig Hemke Breaks Down the War on Free Enterprise in AmericaLarry Fink, Mark Zuckerberg, Ray Dalio, Warren Buffett, and Bill Gates are incredibly wealthy individuals …