Dividend Mania

Become A Wealth Machine

Consistent Payouts: Dividend Investing’s Vital Metrics!

When consistent income is your financial goal, you've got to seek out passive income streams that will accrue on a regular basis. These income streams can do wonders for your investment account as the wealth accumulates and builds and the compounding effect starts to take hold.

Before you know it, you're outperforming more active traders who don't follow basic, sound principles and practices espoused by geniuses like Warren Buffett and Charlie Munger.

It's really not that complicated if you're willing to abide by certain principles. One of the main principles that I follow in my own passive investing strategy, and which I conduct thorough research on every day, is dividend stock investing.

We are committed to bringing you strategies and methods that are safer and more consistent than what you'll hear in most chat rooms and message boards, and dividend investing is one of the best methods I've ever seen when it comes to building wealth.

You see, dividend investing is a little bit like an annuity, but so much better. Sure, an annuity can provide small, regular payments to you over a period of time, but in most cases your principal investment will be 'locked' and inaccessible to you.

Besides, in many cases with annuities, you're primarily just getting paid back the money that you invested in the annuity, with the profits only starting to come if you live much longer than expected.

Now let's compare this with dividend stock investing. Unlike with annuity investing, buying dividend stocks doesn't 'lock up' your money (i.e., make it inaccessible to you). If there happened to be an emergency situation and you needed access to your principal investment, you could simply sell your stocks.

You might sell them at a lower price than you bought them for and you could end up taking a loss if your timing is bad, but at least you would be able to get some of your funds converted to cash if needed. (I don't generally recommend drawing funds from your investment account unless it is really necessary.)

And as I already mentioned, with most annuities, for years you're really just getting paid back what you paid into the annuity. In contrast, with dividend stock investing, you're able (contingent upon the price action of the stock and the timing of the dividend payouts) to start profiting above and beyond your principal investment within a short period of time.

When you buy and hold a stock that provides a dividend, you'll receive dividend payouts for as long as the company continues to pay dividend. These dividends payments typically occur four times per year, but some companies pay them more or less frequently than that.

If you're concerned whether a stock will suddenly stop paying dividends, there's usually no need to worry about that. Check out this list of companies that have been paying consistent dividends for over a century:

Courtesy of Seeking Alpha and dividend.com

Dividends have made up more than 45% of historical total stock market returns.

Do not settle for less than the best dividend payers: Prepare for retirement, starting now!

Follow in the footsteps of investment legends.

As we can clearly see from this table, there are companies that are super-reliable when it comes to paying out consistent dividends to shareholders.

Solid, reliable companies have been providing an excellent source of passive income for generations. When you invest in large-cap companies that have withstood the test of time, oftentimes you'll receive a nice bonus in the form of dividend payments, and these can really add up over time.

These dividend achievers are, in my view, superior companies and that's what makes them more resistant to the ravages of economic downturns and market fluctuations.

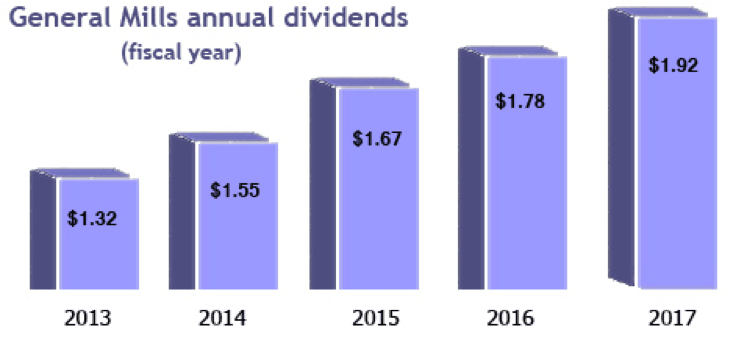

Even when the economy goes sour, you can be confident that you'll still get your dividend payments every few months. For me, I like to find companies that increase their dividend payments (percentage-wise) on a frequent basis, like we see in this example:

Courtesy of General Mills' Investor Presentation

Consistent dividend payment increases show a level of respect for the company's shareholders; these increases are a sign that the company genuinely wants to reward the investors for believing in the company and sticking with it for a long time. It's almost like you're being rewarded for loyalty – a rare and wonderful thing in today's world.

General Mills is a fantastic business, which, of course, must be bought at an attractive price to justify superior returns.

Our team believes in identifying and announcing the absolute best opportunities out there in the markets today. Dividend investing is one of those opportunities; try this strategy for yourself and enjoy the consistent payouts.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Dividend Compounding requires enormous patience and discipline!

Reinvesting dividends for the long-term takes 20 – 30 years.

Successful investing marries long-term safety with short term small-cap expertise for mega-gains!

We publish in-depth research on small-cap opportunities. 100%, 200%, 500%, and 1,000% are possible.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

MOP the FLOOR with US ALL: Globalists Stir Up FINAL STAGE!Seeing as his mother was a holocaust survivor, Jewish director Steven Spielberg became fascinated with …

MOP the FLOOR with US ALL: Globalists Stir Up FINAL STAGE!Seeing as his mother was a holocaust survivor, Jewish director Steven Spielberg became fascinated with …

RON PAUL EXCLUSIVE: Deep State & Banking System Taking Economy DOWN!At 83 years young, Ron Paul shows absolutely no signs of slowing down or easing …

RON PAUL EXCLUSIVE: Deep State & Banking System Taking Economy DOWN!At 83 years young, Ron Paul shows absolutely no signs of slowing down or easing …

CHECKMATE: Record Short Squeeze – CAPITALIZE NOW!Watch these three companies closely – the short squeeze might be immediate.

CHECKMATE: Record Short Squeeze – CAPITALIZE NOW!Watch these three companies closely – the short squeeze might be immediate.