What Has Happened In The Past Week?

There are no circuit breakers in the paper markets for gold. When the manipulators gang up and throw the white towel, sending the futures contracts down to the abyss like a German U-boat, no plunge protection team comes to the rescue of gold investors.

The integrity of the commodities exchange is laughable.

I’m disgusted by the lack of ability to stop these panic-sells that make no sense.

Humans have used gold as money for 5,000 years, and I find it absurd that a positive jobs report, showing that people are finally getting back to work and returning to normal would result in a colossal decline in the price of spot gold.

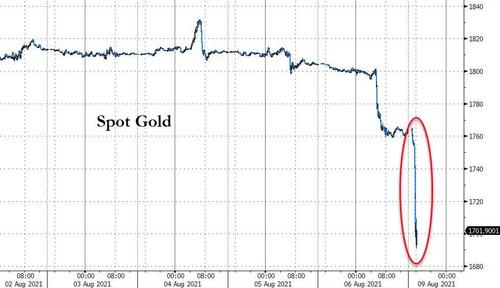

At its bottom, prices plunged to as low as $1,677 or nearly $100 lower than the previous trading session’s close of $1,761.50!

This outright massacre of 24,000 sold gold futures contracts, valued at more than $4 billion on a notional basis, being unceremoniously dumped, is nothing new, and being ignorant of the existence of desk traders at the big firms, who shake things up this way, is plain naïve.

On January 28, 2009, Edward Bases was working at Deutsche Bank when he routed bids to buy 2,740 gold futures contracts valued at around $244 million over the course of 4.5 minutes. At the same time, a fellow Deutsche Bank trader coordinated with Bases and sold his 170 contracts worth $15,172,500, as the price rose.

“That does show you how easy it is to manipulate it sometimes” is what the trader wrote in a chat message to the other Deutsche Bank trader minutes after the trade.

Courtesy: usfunds.com

“I f**k the market around a lot,” Bases wrote in another message.

They caught one trader writing in an electronic chat, “Guys, the algos are really geared up in here. If you spoof this, it really moves.”

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

James McDonald, the CFTC Director of Enforcement, basically admitted that gold and silver prices could be significantly higher if it weren’t for the illegal price manipulation: “If left unchecked, this sort of misconduct can undermine the integrity of the price discovery process.”

JPMorgan, which actually admitted wrongdoing and agreed to pay more than $920 million to resolve market manipulation charges involving two of the bank’s trading desks, ran the biggest spoofing operation of anyone.

Courtesy: Zerohedge.com

Markets in the near-term look spooky, and I can definitely see why the investment community is eagerly awaiting the FED meeting in September, since an acknowledgement on the part of Jerome Powell that they underestimated the duration of the transitory inflation and have grossly misjudged how the public thinks about inflation would result in tapering.

When the FED purchases fewer bonds and mortgage-backed securities, the market can absorb the supply, but tapering is code for “we’ll begin raising rates in 12-18 months” and that’s the main message.

This upcoming September is shaping up to be one of the most pivotal FED meetings of the past decade, so the markets are without a clear direction going into it.

If you understand that it won’t matter in the least if the FED raises rates by 0.25%, then you know that weaknesses in stocks ought to be exploited.

I’ll be issuing the portfolio tab in the coming days, so you can see how I’m buying dips right now!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company and are paid advertisers. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer