I Was Sent This Frantic Message

No need to be alarmed; the price of gold isn’t plummeting, but I was sent this message yesterday, before the FED meeting, along with an attached chart. The sender told me that gold is insanely overvalued right now and that we’re about to see it go down to an abyss of $1,700, when the Federal Reserve continues raising rates into a recession.

I want to show you MY reply to him, because the chart he sent over does suggest gold has rallied too far too quickly, but only when you zoom out do you realize that the chart is FLIPPED!

Here’s the ominous gold chart:

Courtesy: Zerohedge.com, Bloomberg

The chart shows a decoupling, which means a mean reversion process is about to commence. The fear is that because real yields are still positive, the price of gold has rallied without warrant.

As you can see, if yields remain at this level, gold’s price ought to be below $1,700, devastating the entire fabric of the rally.

Here’s what my reply was:

This chart is interesting, but one set of data never tells the full story. Indeed, they are decoupled, but your assumption is that real yields will stay where they are, causing gold’s price to be overvalued, if cash is still attractive.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

I want to challenge that belief and actually suggest that you consider that yields have PEAKED and that we might have seen one of the last rate hikes.

If that’s true, yields are too high.

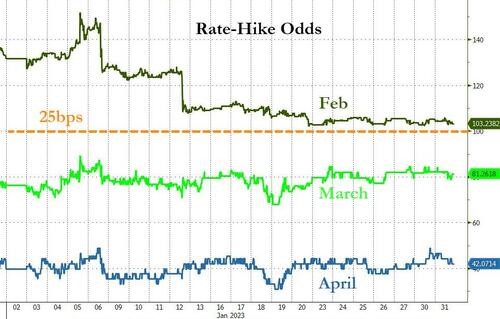

Courtesy: Zerohedge.com, Bloomberg

The markets currently price three more hikes of 0.25% each and here’s where this gets INTERESTING.

The FED is telling investors that it will raise rates more than the level of inflation and that if it must cut, it will do so later on.

The markets didn’t anticipate this strategy; no one wants overtightening for the sake of it, just to loosen the screws later.

Since then, it has softened its stance, but what I think smart money is already factoring in is that inflation has not only peaked, but that it will start coming down – a healthy deflation.

It’s a contrarian view, but here’s what supports this statement:

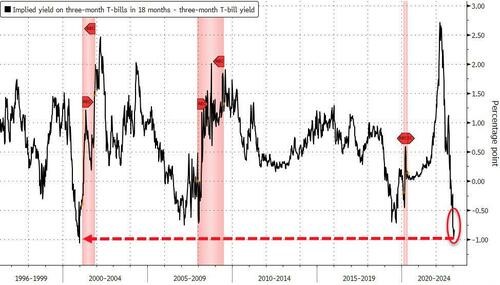

Courtesy: Zerohedge.com, Bloomberg

If we look at the FED’s favorite yield measure, we can see it is at the SAME EXTREME it was in both 2000 and 2009, right before gold made insane upward moves!

At some point in the next quarter or two, the markets will become convinced that companies have fully adapted to the new regime.

We keep seeing layoffs, and the housing market is literally completely frozen.

With all of this, aren’t we to assume a drastic and monumental recession is coming?

I ended my response to him with this question and asked that he read the answer on this publication, so here’s my stance on the recession that I have heard is coming by all, as if every person in the world has now become a financial forecaster.

The recession has already begun – you’re in it.

If you’re waiting for the world to fall into the depths of the Great Depression, it has already in many ways.

Gold is rallying, not because a depression is coming, but because rates, inflation and the FED’s drastic measures are probably all behind us.

All of that translates into a weaker dollar and more gains for gold, which is already above its 2011 highs!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer