Stock Market Wealth

Become A Wealth Machine

GOLD ON HOLD: Consolidation to Lead to All-Time Highs for Precious Metals!

The Federal Reserve is a gold owner’s friend – not a friend you can trust, but we can count on the FED continuing to slash interest rates in order to make the national debt larger. After three consecutive interest rate cuts in 2019, the FED’s intentions are clear, and while this isn’t great for the economy, it’s a gift to the gold market.

Looking back over the past year, we see a profit-making pattern that can be repeated over and over again. Since bottoming in 2016, the gold price has given investors multiple chances to buy pullbacks: in 2019, gold was up 21% at one point, but it has pulled back in order to digest the gains as large-scale investors book their profits.

That’s a natural part of the cycle, as we cannot possibly expect any investment to just go straight up without any dips or consolidation periods. Spot gold tested $1,550 and it will get there again, eventually clearing the 2011 high of $1,900 an ounce – but first it has to take a breather, which simply means that gold is basing and coiling like a slingshot.

Courtesy: InvestingHaven.com

Market experts are expecting a return to volatility in the large-cap stock market indices, so don’t expect smooth sailing in the coming year if you’ve poured your savings into an index fund. All it would take is one event to move the gold price much higher – and there’s no shortage of powder kegs ready to blow.

Just to give you a taste of what this will look like, check out what happened recently when China vowed “firm counter-measures” to the U.S. signing legislation supporting the Hong Kong protesters. The gold price went up as skittish index fund investors crowded into safe-haven assets.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

As the world faces runaway inflation and central bank money printing at full speed, coupled with ultra-dovish central banks in all developed nations, you need to prepare yourself for price increases in gold and gold-related assets. Miners will do particularly well because they’ll magnify and amplify gold’s gains throughout the year.

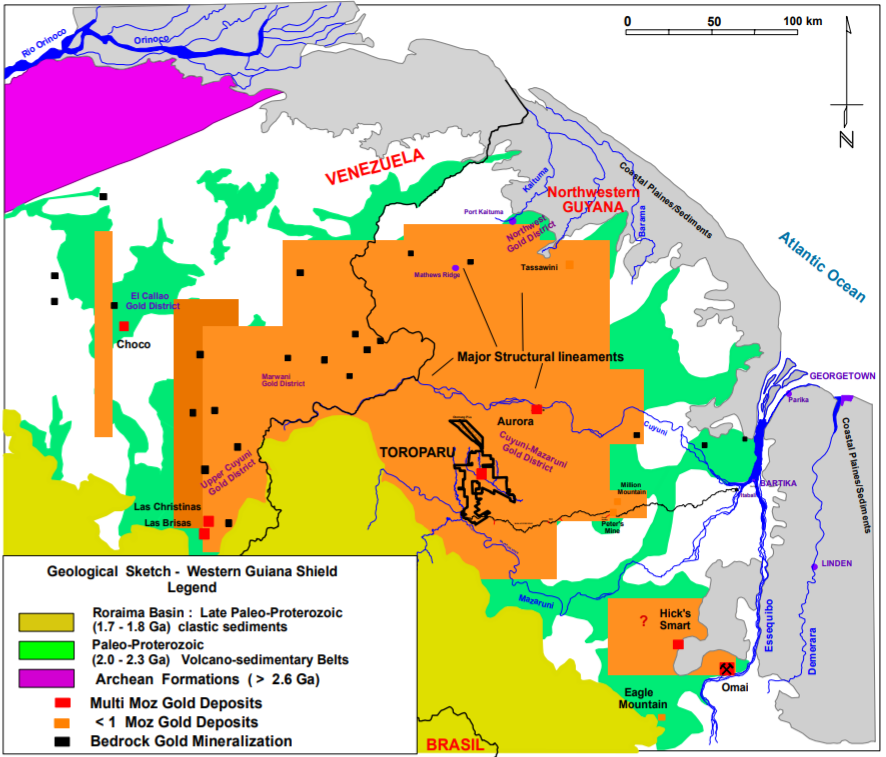

My most lucrative strategy is to use Gold X Mining Corp. (TSX-V: GLDX, OTC: SSPXD) as a leveraged instrument for the bull market in gold. High liquidity, plenty of cash on hand, and strong insider ownership are the hallmarks of a gold stock worth owning, and GLDX/SSPXD has these traits and more – along with an outstanding gold asset in a prime location:

Courtesy: Gold X Mining Corp. Investor Presentation

Gold X also has outstanding leadership, as CEO Richard Munson has more than 35 years of industry experience and he’s handpicked only the best in the business for his team, which includes experienced professionals such as CFO Bassam Moubarak as well as Brian Paes-Braga and Paul Matysek in advisory roles, with large compensation packages, based on performance!

Continuity of management is also important, and Gold X’s management stays on year after year because they’re confident in the longevity and continuing profitability of the company and the resource sector, which will prosper in 2020 in tandem with gold’s next leg up.

If you’ve got physical gold and GOLDX/SSPXD shares today, you’re not afraid of volatility and political unrest; instead, you’re accepting the inevitability of a broad-market pullback and preparing for it. That’s terrific news because now you can have a safe haven and a growth instrument at the same time: peace of mind and powerful profits with gold and Gold X Mining Corp.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

No matter how good an investment sounds, and no matter who is selling it, make sure you’re dealing with a registered investment professional. Use the free, simple search at investor.gov

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Never base any decision off of our advertorials. Wealth Research Group stock profiles are intended to be stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment, we are not stock pickers, market timers, investment advisers, and you should not base any investment decision off our website, emails, videos, or anything we publish. Please do your own research before investing. It is crucial that you at least look at current SEC filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. Never base any investment decision from information contained in our website or emails or any or our publications. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites. We have been compensated by Gold X three hundred thousand dollars for online marketing. We also own shares of Gold X purchased on the open market and their recent private placement. In the future, we may be buying or selling shares without notice. Assume we could be selling shares if you’re seeing this thirty days since its publishing date. Please use our site as a place to get ideas. Enjoy our videos and news analysis, but never make an investment decision off of anything we say. Please review our entire disclaimer at WealthResearchGroup.com

Continued Reading

** MISSILE FIRED: This Stock Went BALLISTIC! **In 1997, I felt bankruptcy on my skin, and it made me despise the helplessness …

** MISSILE FIRED: This Stock Went BALLISTIC! **In 1997, I felt bankruptcy on my skin, and it made me despise the helplessness …

GOLD’s Appetizer Was Tasty. $2,300/oz – Who’s Ready for Seconds?If Picasso were interested in painting bullish charts as a career move, and had asked …

GOLD’s Appetizer Was Tasty. $2,300/oz – Who’s Ready for Seconds?If Picasso were interested in painting bullish charts as a career move, and had asked …

CUT-THROAT VENDETTA: Market Hauled By THE ANKLES!Not even FOUR MONTHS AGO, the Chinese government and the U.S. administration signed the HISTORIC …

CUT-THROAT VENDETTA: Market Hauled By THE ANKLES!Not even FOUR MONTHS AGO, the Chinese government and the U.S. administration signed the HISTORIC …