Stock Market Wealth

Become A Wealth Machine

Gold For Protection, Zinc For Wealth

Many commodity experts are extremely bullish on aluminum, iron, and copper, citing that these metals are important for Trump’s proposed $1 trillion infrastructure plan for the U.S., but the supply available for these metals is enormously abundant.

Gold will be a vital metal for monetary reasons, as well as asset protection in the coming years because inflation is rising globally. But for fat gains, the resources that China craves will be those that become tight in supply. These are critical minerals: cobalt, uranium, and zinc.

Zinc is now in what I call the “Aggressive Takeover” stage.

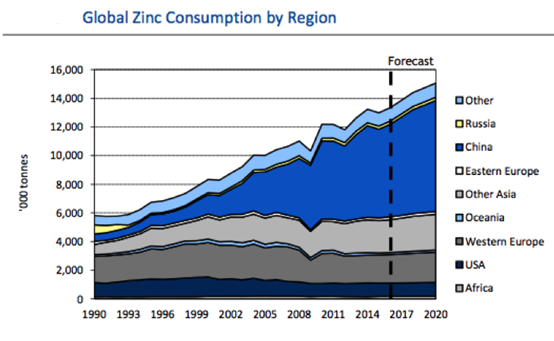

Huge mines have depleted in Ireland, Australia, and leading zinc-producing nations, and we’re now 3 years away from peak production, and China just laid out a $26 trillion infrastructure plan that includes bridges, roads, mega-cities, tunnels, and railways.

China is now urbanizing, and its middle class is exploding.

China’s car market is already the biggest in the world, and Warren Buffett’s major investment in U.S. car dealerships is only the 1st inning to what is now forming in the tight zinc market. This is the 3rd most in-demand metal on the planet, without which coating for iron and steel is impossible, and this anti-corrosion metal is Goldman Sachs’ most bullish commodity position.

What is remarkable about what’s occurring in this market is that new mines are simply replacing the old mines, but the supply is still shrinking and the stockpiles are at generationally-low levels!

Our research shows that there are only a few pure zinc producers, so ramping up operations isn’t the solution.

New discoveries must be made in order to meet global demand.

I took a look at the last zinc bull market, where demand outstripped supply, and out of the 25 best-performing companies, 19 were exploration-stage companies.

This means that 3 out of 4 winners enrich shareholders by making a discovery.

The average 3-year gain for this group was 461%. The 6 highest gainers were mergers of small-cap companies into large-cap ones.

The holy grail of zinc deposits is called a SEDEX (SEDimentary EXhalative), and that’s where fortunes are made.

For example, the Mt. Isa mines of Australia are host to the biggest accumulations of zinc, lead, and silver in the world, but before Mt. Isa, the Sullivan deposit was the largest SEDEX deposit in Canada – and probably the world.

The large billion-dollar companies aren’t set up to perform exploration – they would rather take over small-cap exploration companies once a discovery has been made.

Continued Reading

Destructive Dollar Plunge ImminentWhen I ask the average American about the country that is spearheading de-dollarization (if he …

Destructive Dollar Plunge ImminentWhen I ask the average American about the country that is spearheading de-dollarization (if he …

Gold Extremely Volatile: Stamina Check Underway!1 out of 20 have the DNA of a winner – every year, their portfolio …

Gold Extremely Volatile: Stamina Check Underway!1 out of 20 have the DNA of a winner – every year, their portfolio …

Breakthrough Technologies: Fortunes in 2017 and Beyond!Investing in the Future by Positioning Now The Western World demographics are a combination of …

Breakthrough Technologies: Fortunes in 2017 and Beyond!Investing in the Future by Positioning Now The Western World demographics are a combination of …