Stock Market Wealth

Become A Wealth Machine

I’M CERTAIN: A 40% Drop Is CLOSE!

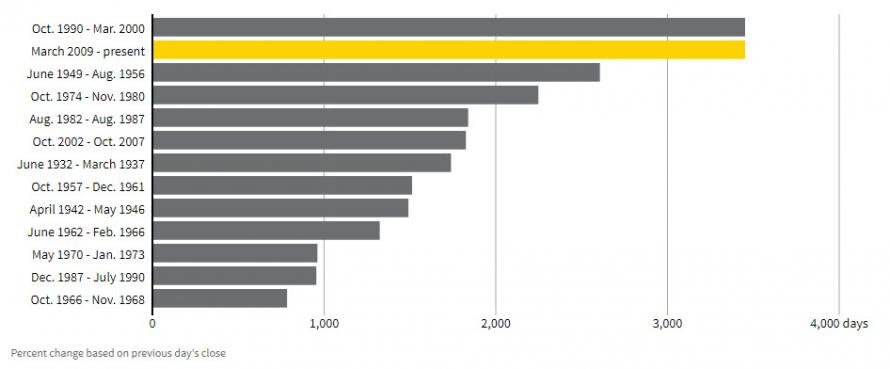

The bull market in U.S. stocks is now, arguably, the longest in history.

In 1990, stocks fell 19.9%, just shy of an official bear market, but history has rounded it up. Alternatively, the longest rally ever has been 13 years long, stemming from 1987 to 2000.

It is true that a 20% decline in prices is considered a bear market, but the indicator, which just flashed, is pricing in a much bigger potential crash.

Let’s look at some stats:

Courtesy: Zerohedge.com

Duration, of course, counts for something. All markets are cyclical, but the U.S. equities rallies since the 1980’s, have been longer than before.

The advent of the internet has made it possible for new types of companies to flourish, which is part of the reason stocks have returned such high returns, far above all other asset classes.

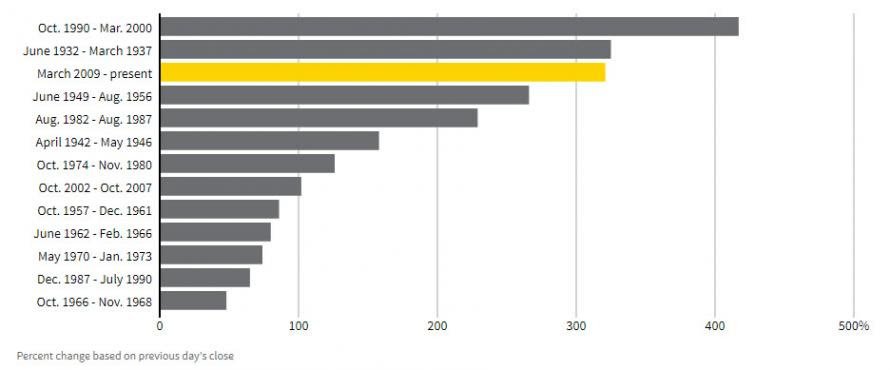

- Returns: Duration isn’t everything, though. The returns, relative to duration, have been larger in previous times. For one, today’s investors are terrified of geopolitical events, so there is definitely no euphoria.

This is the primary reason the bull market isn’t going anywhere, for now. Trump’s victory had probably calmed the market down because it was heading for a top, but the elections changed sentiment and optimism levels.

Today, Main street is optimistic (small business), but not the multinationals, who have bribed (lobbied) politicians for so long to globalize trade and are seeing a U-turn in policy.

You can see this isn’t a bubble, not even close.

The fact that central banks have intervened and jolted returns, along with the recent tax cuts makes the picture even more bullish, since without these turbo pumps, investors wouldn’t have even been sitting on today’s yields. As Charlie Munger recently said, “we’re all undeserving rich investors.”

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

FAKE ECONOMY: THE TRUTH

I’ve been hearing investors and “experts” calling this growth unsustainable, made-up, manipulated, or otherwise, since the 1970’s.

The truth is that the only entity in serious trouble is the Federal Government, but American businesses are alive and well.

Like I wrote on Sunday, the profits are becoming more concentrated, leaving the middle-class behind for good, but the viability of corporations is not to be doubted.

There is a major difference between a great business and a great opportunity because an expensive business, projected by an overvalued share price, isn’t a good sign.

This is, in general, the problem with stocks right now. They are decoupling from the real economy, the real estate market.

Stock prices and real estate prices have foremd a tight relationship, since job creation fuels housing growth, which, in turn, elevates stock prices, because people have a sense of wealth and feel confident to put money into the markets.

This is not the case today:

All of this tells us that the bear market sell-off will, in most likelihood, be horrendous.

As a result, I’ve made several adjustments to my portfolio in the past 60 days.

I’m concentrating my positions (owning fewer stocks), taking profits on big winners, using short-term tools, such as writing covered calls and selling puts, and increasing cash levels.

Therefore, as I noted several weeks ago, on the third Thursday of each even month (August, October, December, and so on), I will publish my personal update, a behind the scenes look at my Dynasty Portfolio.

You can access it HERE!

In addition, I’ve written a bombshell report on the most immediate threat to the dollar – the domestic cancer, which is the intention of several states to issue their own currencies, bypassing the USD.

You can access it HERE!

Big changes are occurring in the world – live the markets, feel its pulse, and let the opportunities come to you.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

Grave Danger: Chinese Espionage in WashingtonAfter dragging America into the Vietnam war, the Chinese were becoming a real problem for …

Grave Danger: Chinese Espionage in WashingtonAfter dragging America into the Vietnam war, the Chinese were becoming a real problem for …

SIRENS GOING OFF: We’re Out Of Time!We've got a number of critical subjects on the plate in front of us, the …

SIRENS GOING OFF: We’re Out Of Time!We've got a number of critical subjects on the plate in front of us, the …

OXYGEN MASKS: U.S. Economy Free-Fall SPIRAL!The beginning of the year is always a good time to take personal inventory. I'm …

OXYGEN MASKS: U.S. Economy Free-Fall SPIRAL!The beginning of the year is always a good time to take personal inventory. I'm …