Spending Cuts or Higher Taxes

For 40 years, Klaus Schwab, founder of the World Economic Forum, has been an influential figure in shaping policies – primarily in the West – and how they relate to other countries and global dominance.

Globalization has peaked and now, clutching at straws, the Davos elite realize that the political backlash around the globe to the globalist movement, are felt and seen by everyone and shape societies and governments.

At this point, we have started a long process of de-globalization, which could last decades.

It’s safe to say that many of the things you’ve taken for granted for the entirety of your life may no longer apply, going forward.

The debt ceiling in the United States, which has been breached just under 100 times, will now become a political stage to have an uncomfortable discussion: who and what gets cut from spending and when.

At the peak of globalization, the U.S. Treasury was able to spend without repercussions, and thanks to dollar hegemony, the globalists ruled the agenda and were lords of the planet.

With the end of the deflation era and the fracturing of the Petrodollar system of 1971, America’s next presidential debate will be centered upon austerity, an issue Americans haven’t heard in 40 years!

$1.22tn in annual Social Security and $914bn in Medicaid expenses, as well as $865bn in income security programs, will be challenged.

Courtesy: Zerohedge.com

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

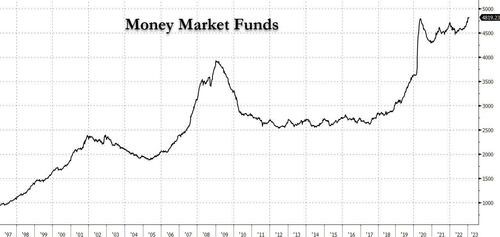

What money-market accounts at record levels are telling you is that the zero-rates world, where getting paid for your cash to sit in a bank account was killing savers, is behind us.

Today, investors demand a high interest rate for their money, because of the inflation in the system.

Many companies don’t want to grow with debt, and investors don’t want to finance projects that can’t yield 10%-12%, which means either prices must come down more or investors will have to settle.

So, with the United States’ globalist dominance attacked from three crucial angles, at the same time, we must be able to course-correct and zig-zag with the times.

Here are the major threats to America’s globalist rule:

- Petrodollar system – the Saudis are clearly playing games and want to hedge their reliance on America with protection offered by the Chinese.

They now have another option.

- Borrowing costs – just a couple of years ago, the Treasury paid 0.5% interest and today it has exploded by 700%, to 4%.

- Nationalism – it seems that Americans are rejecting globalization in droves.

They don’t want to hear about how goods come to them so cheaply, by offshoring jobs. They don’t care about consumerism that much, if it means inequality within.

They don’t want to fight to keep other countries at bay; what they want is to change the way America does business, by being more independent.

Klaus Schwab is clearly losing a globalist battle; far too many are rejecting any notion of it and the next President of the United States will have to make tough choices, because inflation is how democracies die.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer