Stock Market Wealth

Become A Wealth Machine

The Power of Real Estate Investing

Cash-Flow Wealth

Outside of the Stock Market:

The Power of Real Estate Investing

Throughout recorded human history, the key to wealth has been owning own land.

Today, this investment strategy still holds true. In 2017, Wealth Research Group will publish 3 comprehensive reports about proven strategies, simple action steps, common mistakes, and ways to avoid pitfalls when building a real estate portfolio from scratch.

We will share what my partners and I have done personally to build our real estate holdings, because it’s important to own assets outside of the stock market.

I began accumulating residential real estate in 2009. The crash in the U.S. market made many markets attractive, and with the troubled mortgage industry, the percentage of people renting was rising, and so were rents.

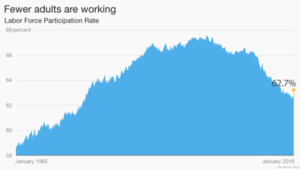

As you can see, most U.S. citizens are cautious of originating a mortgage in today’s environment.

Even with ultra-low interest rates, the feeling of insecurity persists within American families, and they choose to rent, rather than own.

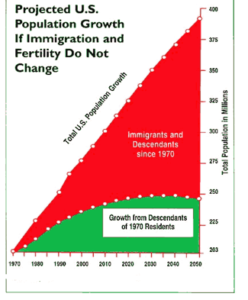

The U.S. population is growing, mainly due to immigration.

With the expected population reaching 400 million so soon, the real estate market will continue to create new millionaires every year.

What the research we conducted points to is that there will be a number of niches to focus on that will be far more profitable than others.

The most important component of the action steps we will lay out in our series of exclusive reports in 2017 will be that we divide our step-by-step plans of action into 3 categories of net worth so that even if you have no experience and a relatively low net worth, one of the programs will get you started quickly.

Our mission at Wealth Research Group has been to strengthen your financial fortress daily, and we will keep providing value and actionable advice for years to come.

Advantages of Real Estate Holdings

The primary reason I love real estate holdings is due to a timeless principle of investment success: Intelligent Asset Allocation.

It is an additional layer of wealth that is not connected to what the stock market is doing.

Tenants pay monthly rents no matter what the S&P 500 is up to, and that’s a critical cornerstone of a balanced portfolio.

Real estate holdings also have many advantages when it comes to taxes, which we will cover as well.

One of the key characteristics that I am attracted to is that almost any aspect of the transaction can be outsourced to experts, from searching for the right homes, evaluating the property, making the offers, closing, the transaction (paperwork), renovating, managing the property, and collecting rents.

Hands-off investments clear your time to do the most important thing: negotiate and look for more opportunities.

In real terms (purchasing power compared to other assets), the price of U.S. homes has remained steady for more than 100 years, except for the real estate bubble of the 2000s.

That means that your primary focus is to own real estate for cash flow, and we will cover some of the best markets to focus on going forward.

The U.S. is an enormous real estate hub – if Bill Gates were to invest his net worth in Phoenix, AZ, for example, the market would “swallow” those billions in 2-3 weeks.

The opportunity is immense, but not all metropolitan areas present the same compelling profitability.

With fewer adults working, some of the best profit centers are in nursing homes, hospitals, mini storage units, and real estate that is leased and rented to government agencies.

Obviously, as an individual, it’s nearly impossible to own these types of assets, but I have found incredible ways of getting involved in these markets through publicly-traded REITs that pay 6%-10% dividends.

Since rising rents are a function of low unemployment rates, fewer state taxes, affordability, and home supply, looking at these stats is extremely important. One of my secret strategies is watching the new building permits issued by contractors to get an indication of how many more units are coming in the next 6-12 months and calling the chamber of commerce and getting an idea of which large corporations are moving into town, how many jobs they plan to create, and whether or not they will they be high-paying jobs.

Rising interest rates will make the real estate market very interesting to watch.

On one end, higher rates make banks want to lend more, which will surely ease the lending requirements and allow more individuals to become qualified, but on the other end, rising rates make real estate less affordable, which means that people who think that rates are going to keep climbing will want to rush to get new homes in anticipation of further rate increases by the FED.

If that happens, don’t chase prices higher. In our debut report, which will be published in mid-March, we will show you how to avoid overpaying for real estate with a proprietary multiplier formula we personally use to look at prospective investments.

3 out of every 4 millionaires have had their wealth connected to housing in some way or another, and it’s important that as investors, we follow what is working.

Continued Reading

MOST IMPORTANT UPDATEWhile compiling the information about NEXE Innovations (TSX-V: NEXE & US: NEXNF), We learned an …

MOST IMPORTANT UPDATEWhile compiling the information about NEXE Innovations (TSX-V: NEXE & US: NEXNF), We learned an …

The Stock Market Is Trying to SWINDLE YOU – It’s Time to PROTECT YOURSELF NOW!Unlike the Dow and S&P, gold and gold miners have been making new highs and …

The Stock Market Is Trying to SWINDLE YOU – It’s Time to PROTECT YOURSELF NOW!Unlike the Dow and S&P, gold and gold miners have been making new highs and …

MEGA-SQUEEZE AMC/GME: D-I-S-T-R-A-C-T-I-O-N!My five-year-old daughter keeps asking me to take her to the circus. What kid doesn't …

MEGA-SQUEEZE AMC/GME: D-I-S-T-R-A-C-T-I-O-N!My five-year-old daughter keeps asking me to take her to the circus. What kid doesn't …