Stock Market Wealth

Become A Wealth Machine

Silver $29.02 is Imminent

I am now more bullish on silver than I’ve been throughout the past 2 years.

Gold could easily make a move to $1,474, and using the gold to silver ratio’s annual trend line for the past 2 years, we could reach 59:1 in the coming months.

That would send silver to $24.98 per ounce.

But silver isn’t experiencing just another routine January and February price action – instead, it is mimicking price movement that last happened in May of 2006.

A 9.6% decline in supply for the metal over a 36-month period is the steepest production decline since the World Bureau of Metal Statistics began tracking production in 1995.

Silver is now up for 9 straight weeks. When that last happened in 2006, we saw a 58% move to the upside, which would lock silver at $29.02!

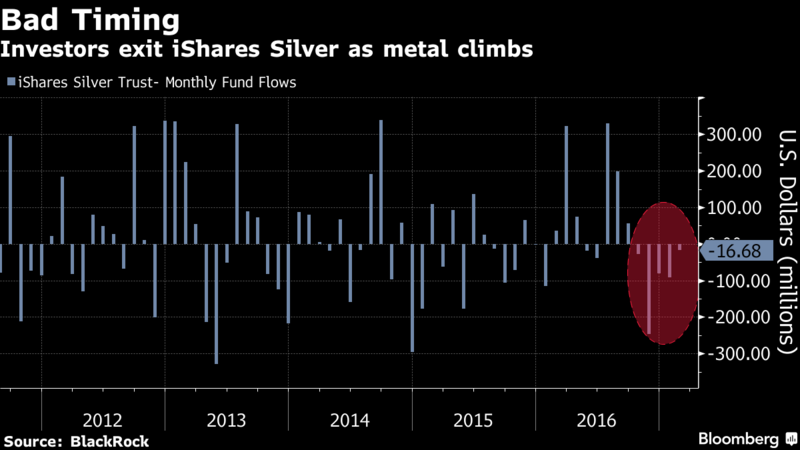

The amazing lesson in traders’ behavior is that during this time, there are massive outflows from silver ETFs. That is why commodities are seriously intense on investors’ emotional discipline – most will always be the victim.

It is critical that you learn the 5 timeless principles of investing success, in order to stay ahead of the game.

Contrary to amateur investor activity, today’s data will put you in the driver’s seat and allow you to make informed decisions.

Today, prices are rising while the market is fairly bearish – there isn’t a more ideal catalyst for sharp moves higher than a hated commodity breaking out for the first time in years.

Silver is 2017’s best-performing asset.

Output from mines was expected by CPM Group to fall in 2016 for the first time since 2011. Supply is declining at a time when demand is rising from industrial users, including makers of jewelry, electronics, and solar panels.

Silver going up to $29.02 would price gold at around $1,712, and at that price range, miners will be profitable for the first time since 2011 as a group.

Wealth Research Group has been patiently tracking the technical outlook for the metals, and it is as solid as technical indicators can get.

In fact, David Einhorn, famed billionaire hedge fund manager who has been earning his investors higher returns than Warren Buffett since the year 2000, is bullish again.

Stanley Druckenmiller, who has averaged 30% annual returns for investors of his fund, has bought a huge amount of gold.

Remember, when the market sentiment is bearish but prices are in an uptrend, the biggest gains are made in the shortest amount of time.

Mining companies are able to grow and fund expenditures at the pre-production stage (exploration, permitting, and construction) by issuing debt, and the higher their share prices are, the less dilution there is – if miners are profitable and exploration-stage companies are able to drill and explore, I will personally be committing funds to the best companies in the sector.

Yet, as you can see, going long on silver has been a contrarian trade – most traders have exited the ETFs.

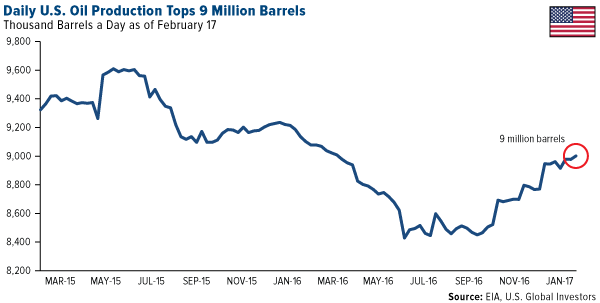

The silver market is healthier today than it has been in 5 years, and with the oil glut, especially in the U.S. market, the energy expenditures these companies undertake is sustainable.

In my conversations with fund managers and CEOs, I can tell you that even they are only cautiously optimistic.

In 2016, the miners broke out in a strong fashion around the same time PDAC, the largest annual mining convention, took place. This year’s event is one week away, March 5th-8th, and my contacts will be on the ground, updating on exactly what’s being said between the industry’s smartest players.

Continued Reading

In GOLD We Trust: PIVOTAL Societal Changes COMING!If you’re invested in U.S. equities right now, or are just thinking about dipping into …

In GOLD We Trust: PIVOTAL Societal Changes COMING!If you’re invested in U.S. equities right now, or are just thinking about dipping into …

Professionals Don’t Play AroundIt was back in September of 2009. My wife and I were kind of quiet …

Professionals Don’t Play AroundIt was back in September of 2009. My wife and I were kind of quiet …

THE BANKS ARE ALL GOING TO IMPLODE: Jeff Berwick on the Failure of the Fiat RegimeIt’s a discomfiting truth that many millions of people in America and around the world …

THE BANKS ARE ALL GOING TO IMPLODE: Jeff Berwick on the Failure of the Fiat RegimeIt’s a discomfiting truth that many millions of people in America and around the world …