Stock Market Wealth

Become A Wealth Machine

STRAP Yourself In: HERD is BULLISH, Top is NEAR!

*** On Sunday, we published part 1 of RISK MANAGEMENT: OPERATING IN THE BEAR MARKET, which you can access HERE, and on Tuesday, we published part 2, which is available HERE. ***

Today, we’re publishing part 3, the final section of this complete playbook for sophisticated investing in bear market conditions.

All three parts are available in one detailed and essential PDF HERE.

After going over 5 of the 11 critical strategies I’ve observed as vital for succeeding at building wealth through bear market cycles, today we focus on the remaining 6, out of 11 we have showcased this week.

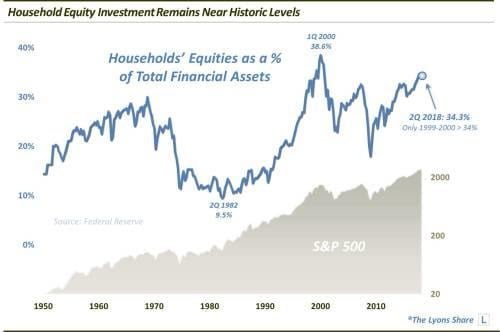

As you know, I’m extremely cautious on new positions at the moment, selecting only companies that can trade virtually irrespective of general market trends because the herd is getting bullish after 10 years at precisely the wrong time, just as they historically have.

Take a look at the following stat:

Courtesy: ZeroHedge.com

It’s amazing how public participation by individual investors coincides so perfectly with market tops and with market bottoms.

Now, participation can remain high for a year or two, so it is not an immediate signal to alter your trading patterns, but it is further evidence that the cycle is ending for U.S. equities.

RISK MANAGEMENT: OPERATING IN THE BEAR MARKET

11 STRATEGIES FOR SOPHISTICATED, AGGRESSIVE TRADERS!

6. Start-Up Investing Mindset: Going into trades with the state of mind that this is a position that can bring incredible returns in a matter of weeks is easy, but going into it with the idea that it could be dead money for several years before the value creation finally occurs, is hard.

But this is precisely what you must train yourself to think.

In the 2011-2016 bear market, I built a position with a company that traded between $0.31 and $0.87 when my price target for it was $2.54. I saw my position go down by as much as 38% before the 2016 bull market sent the stock price to $2.82, resulting in an extraordinary 5-year return of 494% in total.

Have patience.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

7. Watch List: Since a bear market forces many companies into bankruptcy and liquidation, building an internal database, consisting of around 30 companies in total that can be regularly amended by erasing mediocre ones with exceptional ones is a brilliant strategy.

Even if you choose to wait on the sidelines, not investing a penny until you see upside trading and stocks beginning to soar, you’ll be among the first to take action because you’ll be tracking 30 stocks you’ve done research on in advance.

I have a database of 68 Legacy Dividend stocks for my long-term portfolio, for example.

8. Royalty/Streaming Companies: Even within cyclical sectors, there are a select few companies that are able to run a business model that bypasses some of the inherent volatility of the sector.

In the natural resource industry, 3 companies have been able to remain profitable, growing, and cheap during the bear market and have offered great returns to investors.

It’s extremely rare, but doable.

9. Lottery Tickets: 180 degrees from these less cyclical, far more stable business models I alluded to in strategy No. 8, lie the “Lottery Tickets,” which are the highest-risk companies anywhere since in all likelihood, they will fail.

Since 90%-95% go bust, the remaining 5%-10% enjoy unimaginable returns when things go right for them.

A number of examples are early-stage exploration companies that drill holes in the ground, not knowing if there are any minerals beneath the surface, what quantity there is of them, and how easily extractable they are.

Drug companies that await FDA approval can rally hundreds of percent on positive news or die upon refusals. Companies filing patents are another example of businesses that can result in overwhelmingly good returns, when their ideas become protected by law.

The bottom line is that these companies’ success has nothing to do with overall market conditions. In other words, taking a position in one of them during a bull or bear market carries the same risk, but in a bear market, they are among the rare few that can offer big rewards.

10. Physical Precious Metals: A critical component of being a prepared investor is to understand that the USD era is unwinding.

Every person on the face of the Earth should own some physical coins or bars made of silver, gold, or both.

The goal is not to become wealthy by owning them, but to own as much of them as possible.

Therefore, a bear market allows a person who earns a fixed income to buy more, not less, over time. During the 2000-2011 bull market, as the price rose every year, your purchasing power diminished in terms of ounces that can be bought.

The conclusion is that the bear markets are advantageous for investors who have yet to build a physical precious metal position.

11. Diversification: During a downturn in a certain industry, one of the premier lessons is to expand your knowledge base, so that you can focus on booming ones, in the meantime. There is no reason to be like a fly that is constantly trying to exit the room through a closed window.

Instead, look for alternatives.

Wealth Research Group was one of the pioneer newsletters to profile mining stocks in 2016, highlighting 12 of them in total that soared by over 100% each.

More than six of them returned over 200%, out of which two had risen by more than 400% each.

But in 2017, we realized that the market had zigged, and we zagged with it, being the FIRST newsletter ever to profile Ethereum at $12 a coin, a position that helped many subscribers earn an 8,000% return in 7 months!

All in all, we profiled 6 cryptocurrencies, all of which gained over 1,500% last year, each.

In 2018, we again changed our outlook, focusing on the cannabis sector, which is the best-performing industry in the world right now.

Diversification, not concentration, is what differentiates disciplined investors who follow the money instead of their emotions. Warren Buffett was famous for saying that he “will never buy an airline stock again” about 30 years ago, but has been a huge buyer of them in the past 6 years. Only a mule doesn’t change his mind.

Everyone loves to see their own ideas become big winners, but in order to be a wealthy investor, we must follow what works, not what we want to work.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

POWELL GRILLED in CONGRESS: INFLATION CRISIS!What's been happening in the past three weeks is incredible, and I think it's paramount …

POWELL GRILLED in CONGRESS: INFLATION CRISIS!What's been happening in the past three weeks is incredible, and I think it's paramount …

A BIG 2021 POSITION!We believe that this could turn out to be one of the most successful companies …

A BIG 2021 POSITION!We believe that this could turn out to be one of the most successful companies …

MARKET’S FINAL STRAW: Suckers Buying – VETERANS JUMPING SHIP!The markets have GONE UP, almost in a straight line, since the March 23rd lows. …

MARKET’S FINAL STRAW: Suckers Buying – VETERANS JUMPING SHIP!The markets have GONE UP, almost in a straight line, since the March 23rd lows. …