Too Much is Priced In

In my favorite book of all time, a little work titled The Greatest Thing in the World by Henry Drummond, written in 1891, the author talks about the characteristics of the ideal human being. Out of the chief nine traits that comprise this individual and his relentless pursuit of improving upon them, he names ‘Sincerity’ and clarifies what the optimal mind defines as being sincere.

He explains that the sincere mind does not celebrate being right, but celebrates uncovering the truth.

There’s a profound difference between the two and I think it’s worth diving into for a minute, because this has not only philosophical and spiritual connotations, but also real-world financial observations and consequences.

Warren Buffett’s quote that the market doesn’t know you are LONG the stock is essentially the same as Drummond’s explanation of pure sincerity, which he boils down to being satisfied and content with finding out the truth, instead of patting yourself on the back when you’re right, and blaming the world when you’re not {as opposed to accepting it with a sigh of relief that now you finally have a grasp on reality}.

Those who oppose reckless fiscal and monetary policies and loose lending standards equate these with the bullish case for gold and think that its price should be far higher, not to mention silver’s.

With the debt ceiling approaching the X-date, which is now June 5th (the day Treasury runs out of money), and with recession probabilities at multi-decade highs, along with persistently-elevated inflation, they can smell gold’s record price coming in short order.

Courtesy: Zerohedge.com

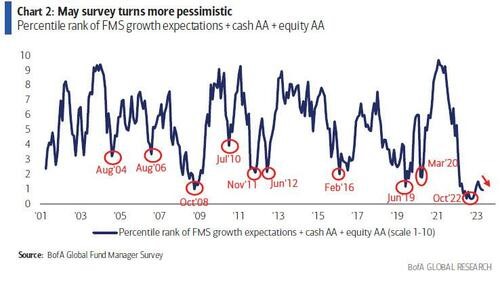

As you can see, the mood on the street is certainly pessimistic. Gold has been rallying big over the regional banking crisis, which prompted speculation that the contagion would not be limited to just a few institutions, but for now, some 4,000 banks in America are, indeed, chugging along just fine.

If the regional banking crisis turns out to be manageable and the debt ceiling is raised, those are two catalysts that not only disappear, but also raise the odds that the FED might sneak in another rate hike in June.

My point is that the crowded trade of LONG gold/SHORT dollar looks to be at a premium.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

I’m happy to be wrong, but the price action shows that my warning from last week is turning out to be true:

Courtesy: Zerohedge.com, Bloomberg

I am a gold bull and I do believe that gold will reach all-time highs in the months ahead, but I’m not placing much faith in that happening before the FED finally caves to pressures and cuts rates.

As it stands, when I look at the CME FedWatch Tool, I see not only that bonds futures leave the door open to a June rate hike, but also that in December 2023, interest rates will still be over 5.00%, where they are at present.

It seems like the world is coming to terms with inflation staying put and the need to tighten the belt on expenses. Everyone seems to be on board, except for the government, and that’s why I believe the next U.S. election campaign will be about spending responsibilities, and that is a major change.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer