Full Tank, New Tires, Ready for Action

I love gold. Why even debate the matter? Since 1971, gold had done exactly what it is meant to do: crush, beat, destroy, humiliate, annihilate and vanquish any fiat currency that any country has put in front of it, thinking that its internal economy is stronger than the universally-accepted coin of choice for kings and for societies big and small, throughout the past 5,000 years.

I love it.

I also think that it’s no secret that governments and central banks respect it, except for the country that is trying to defend and preserve its currency as the global reserve, the United States.

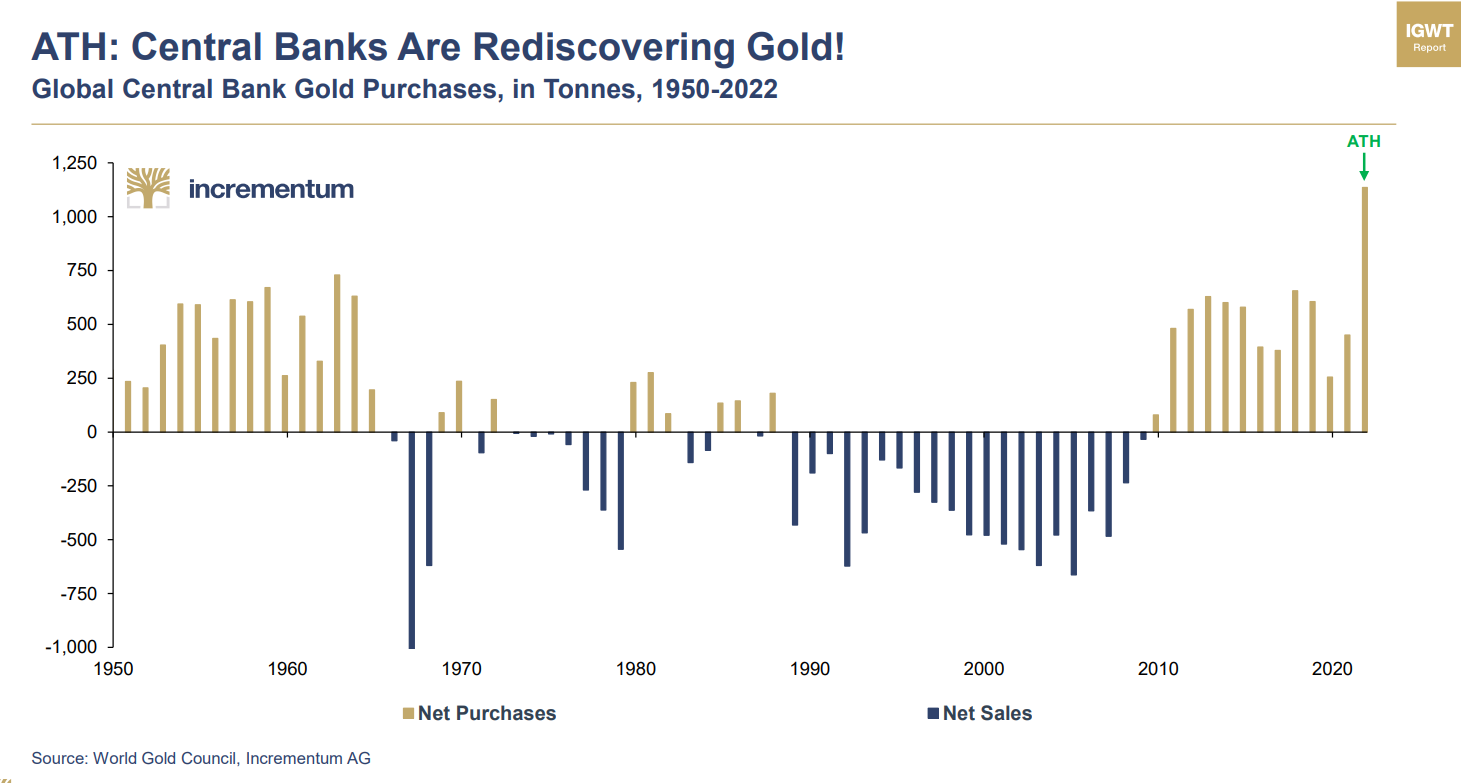

But Bernanke comments aside, central banks love gold; I mean they REALLY love it:

Courtesy: Incrementum AG Chartbook 2023 (A must-read, IMO)

They spent the entire calendar year of 2022 buying a record amount of it… unless I’m missing something here, I think it’s safe to say they are rejecting the dollar.

So they don’t like other currencies, I can see why… The Eurozone is slowly falling apart, China is a huge mess, Japan peaked three decades ago and the other stable nations are small and insignificant.

The vacuum created by the absence of an adequate replacement for the petrodollar, in a time when the Saudis are turning their backs to the U.S. – and the Americans are not worried about it, since they struck it rich with shale deposits – has started to be filled by China and Russia, but also by Germany, Japan and India. They are all seeking to become regional dominators, understanding that though the USA is top dog, it is a tired dog.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

But what about silver?

It’s been kind of left for dead since 1944’s Bretton-Woods agreement, completely demonetized by central banks and governments, loved for its monetary reasons, only by a small group in the public who swear by it. Can silver finally fulfill the promise of its die-hard fans and return to trade at some of the more historical ratios with gold?

Courtesy: Incrementum AG Chartbook 2023 (A must-read, IMO)

Silver lags. This is some theory that I came up with; it’s reality. Silver rallies after gold proves the trend.

Once a trend is firmly in place, silver surpasses gold, percentage-wise, only to be outpaced by the more leveraged assets in the class, the companies that engage in the mining industry.

When I launched Wealth Research Group in Q1 2016, gold and silver were snapping out of their disinflationary bear markets, which halved gold’s price and brutally tanked silver’s price by over 65%.

Since then, gold has doubled and silver has also doubled.

As you can see above, what we are living through is the most inflationary period in at least three decades and the jury is still out on that.

Silver has held well, trading above its long-term support of $18/ounce and its most recent support of $22.50, which makes me extremely confident that silver is going to rally, once gold shows its resolve to go over the $2,000 landmark, and I wouldn’t be shocked to see silver at levels above $30, as the FED begins cutting rates.

I’ve got much more to show you because we’ve definitely turned a corner on silver. Suffice it to say: I love gold, but I really love silver.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer