That’s a Wrap, Ladies and Gentlemen

On July 26th, which is this upcoming Wednesday, the Federal Reserve will raise the FED Funds Rate to 5.25%-5.50%. I know this because the market probability of it is nearly 100%.

Take a look:

Courtesy: CMEGroup.com

The markets wrongly thought the FED was done already, but this one feels right.

The CPI prints have been coming down steadily, and I have listened to real estate fund managers that manage billions of dollars, and they’re pretty confident that we’re not going higher.

Most don’t think we’re going to see any cuts, either. It seems that “higher for longer” is the consensus up until March 2024.

Assuming this probability becomes more engrained in the pricing of assets, it would mean that lenders would resume originating mortgages, developers would take on construction loans, and buyers would come back to the negotiating table.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

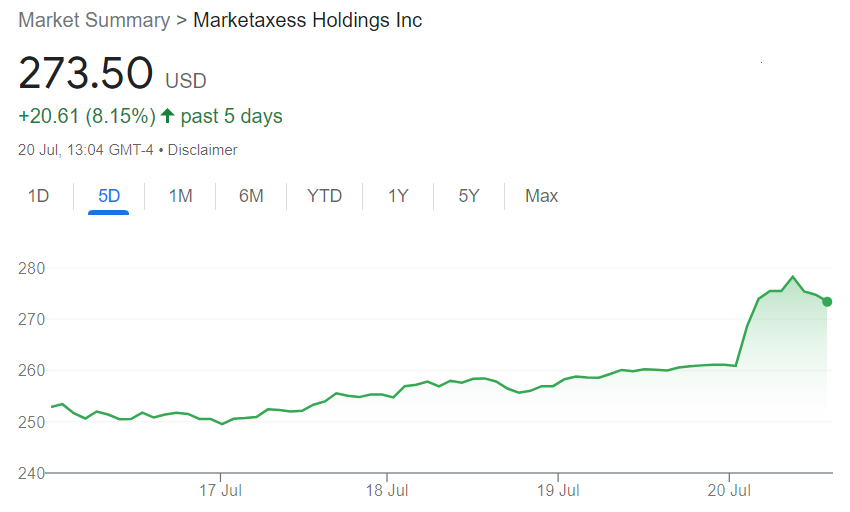

Markets are already selling off in response to this, and MarketAxess (MKTX), one of my ultimate stocks to own during the rate cut era, has been one of the best performing companies this past week.

Gold has also jumped big right along with silver. Gold is just a few dollars away from $2,000/ounce, which seems to be a standard for it nowadays…

Even with my excitement about the prospects of new all-time highs for gold and my forecast of silver hitting $30/ounce before year-end, I have learned that there’s one commodity, which America solely relies on for a very particular use and would be difficult to FUNCTION without, which is a superior inflation hedge and seems to be better-equipped for handling recessionary shocks that I’ve never thought about before, until very recently.

In my months-long research of the matter, it became evident that in North America, as opposed to gold and silver, of which there are multiple mines that are being put into production with no supply deficits, this particular commodity is in a serious domestic supply shortfall and there’s ONLY ONE project that is moving towards production!

This company, just so we’re clear, has been actively searching for a new CEO, who will have one key job – to take this deal over the goal line, and that includes a potential buyout.

I believe that it is a tremendous opportunity, so much so that I’m going to spend this weekend, telling you again about it, so that NO ONE can say in a year from now that he didn’t get advanced notice.

On the table, on top of a new CEO, is the upcoming release of a Feasibility Study, the last piece of the puzzle that a CEO needs, in order to shop for a buyer for the asset, or plan for production.

The cherry on top is that this company is also the largest shareholder – owns nearly 30% – of a highly attractive recent spinout – currently still private – that could potentially provide all the necessary underground energy storage for a massive proposed Clean Energy Hub.

Wall Street has been stunned by gold’s recent brush with $2,000; don’t allow yourself to be stunned, when this company advances its project towards an EXIT STRATEGY.

Use the weekend to research it thoroughly. Start HERE!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer