We’re currently drafting a letter to Warren and Charlie addressing the company’s decision to own shares of Barrick Gold. As the largest mining company that focuses on gold, its market cap is $53bn, compared with the $130bn in cash that Berkshire currently has on its books.

If it really wanted to, Berkshire could purchase 10% of Barrick and it wouldn’t EVEN REGISTER as an earthquake. Every year around the globe, there are 900,000 earthquakes with a magnitude of 2.5 or less, which aren’t EVEN FELT; $5bn out of $130bn is 3% of its disposable cash and won’t make any material difference to Berkshire – that’s how small the gold industry is, compared with the amounts of money that can flood INTO IT.

When it comes to MAJOR INSTITUTIONS, their budgets are unreal.

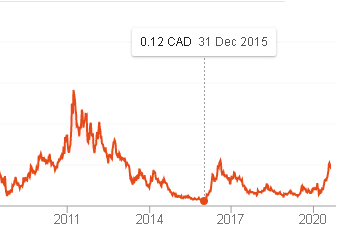

Check out this chart from 2016 of the gold junior stock:

At the 2008 lows, this stock traded for CAD$0.23 and at the 2011 HIGHS (which we’re not even close to YET) it traded above CAD$2.70. At the 2015 BOTTOM, it traded as low as 12c and by August 2016, it again traded above A BUCK, only to fall to CAD$0.29 in 2018 and KISS A BUCK again today.

Junior mining companies are SUPER-CYCLICAL – even if Tim Cook, Elon Musk, Jeff Bezos and Bernard Arnault were jointly running one it wouldn’t matter and they would have had to deal with the INHERENT NATURE of it.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

These TINY OPERATORS, which many times aren’t even mining yet, are like responsible adults riding an amazing rollercoaster. No matter how much the adult tries to deny that he’s on a rollercoaster, it doesn’t change facts; he will feel HIS STOMACH TURNING, even if he’s been on the ride many times. CEO’s can’t change the game, so the BEST ONES adapt to the rules and make it work!

Courtesy: Zerohedge.com

Just like in 2009, we’ve started a new bull market in equities. Many DON’T ADMIT it, can’t bring themselves around to believe it or are just in shock at how QUICKLY IT CAME ABOUT.

Nevertheless, it’s on. Markets are already trading at all-time highs, even though indices fell by 35% in SIXTEEN DAYS in March, due to the coronavirus scare.

The previous bull market cycle, from 2009 to 2020, coincided with a dollar bull market, but this one is GETTING COUPLED with a dollar bear market.

We anticipate in the next 13F filings from Berkshire Hathaway and other VALUE FUNDS that more of them disclose stakes in the major mining companies and royalty companies.

As you can see, this rotation is already taking place. Investors understand that while tech companies will continue to be critical to our WAY OF LIFE, the value is elsewhere (since tech is fully priced), if the dollar is weak.

The top chart of that junior miner was put there for a reason. As you can see, if you’ll scroll back up, it is STILL TRADING below its 2016 high, even though gold is $1,966, not $1,380, as it was back then (2016), and even though silver is $28/ounce, not $21, as it was back then.

That random stock trades for about a 60% DISCOUNT with its 2011 high, which implies that it still has a 250% UPSIDE POTENTIAL, even if metals DO NOTHING for months and remain at these levels.

I’m telling you this because investors aren’t euphoric on the mining sector. When gold PUKED last week, traders were selling IN DROVES.

The bottom line is that Buffett OPENED THE DOOR to other fund managers; it’s only just GETTING STARTED!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/disclaimer