Stock Market Wealth

Become A Wealth Machine

Utter DOMINATION: Take A CLOSE Look!

Investors have been capitalizing on the fact that central banks have been buying bonds, mortgage-backed securities, and stocks for nearly a decade at a frantic pace, keeping prices artificially high, but now, they are beginning to ask themselves what will occur, as these institutions either liquidate their portfolios or normalize its size.

For example, we’ve been discussing the balloon-sized bonds portfolio of the Federal Reserve and what it means to the market when they attempt to sell it, but now I’m more concerned with how the Federal Reserve will handle a 30%-40% drop in the price of its bonds portfolio.

You see, the implications of rising yields on the price of bonds are simple to understand – as interest rates rise, prices drop.

The timing of this couldn’t be worse.

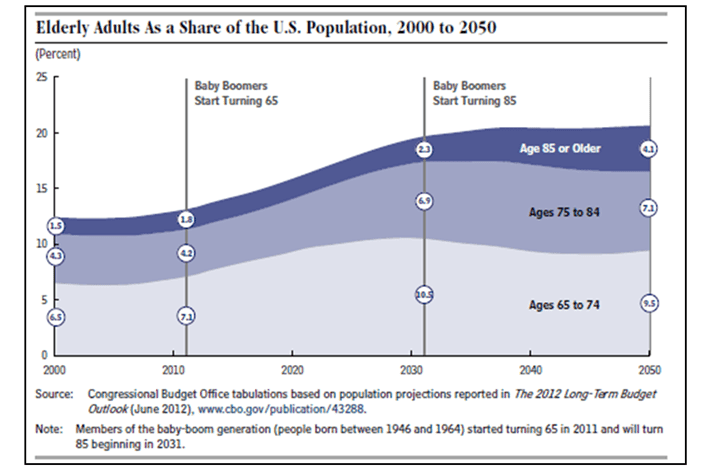

Today, 51 million people are in retirement in the U.S. alone. This number is set to grow by 60% and hit 80 million by 2030.

Courtesy: Suredividend.com

There’s no avoiding or denying the fact that the U.S. is aging, but due to the high standard of living and availability of top-of-the-line medical equipment, demographic projections show that the elderly are multiplying in size.

I’m currently in Costa Rica, in one of the only “Blue Zones” in the world. These are areas, where people are living to be 100 and still functioning well.

It’s an incredible testament to the fact that living a certain way creates longevity.

But, in the western world, it’s a different story altogether.

The nutritional habits of the people living here have been eye-opening for me, and I’m already adopting a number of key routines.

In the U.S., though, healthcare is a costly business. 80 million people will soon be eligible to government subsidies in the form of Medicare/Medicaid, and there aren’t enough Amazon’s and Apple’s on the planet to satisfy the black hole called the Federal deficit, through tax collection.

The Federal government has spent over $4.1 trillion, yet it has collected only $3.4 trillion. Its deficit is $700 billion and growing.

Just to meet obligations to the retirees via the Social Security and Medicare/Medicaid, the federal government is paying out $2 trillion, and this amount is rising at a rate of $160,000 a MINUTE.

50% of the population is receiving some form of government aid – that’s half of the people!

The most alarming aspect of this situation, though, is the bonds market.

Today, the 10-yr Treasury bond is yielding 2.85%. Take a look:

Courtesy: CNBC.com

As you can see, yields have already bottomed. Now that they’ll begin to rise, the prices will tank.

This is huge and has such broad ramifications that even if you’ve never owned a bond or intend to own one, it can impact your life in many ways.

- Foreign governments are adding $600,000 worth of Treasury debt every MINUTE.

Simply put, this means that the U.S. Federal government can pay its own citizens and applicants for food stamps, disability, income security, and Federal pensions, on the back of other countries.

That’s insanely risky.

In total, over $6.3 trillion are held by foreign nations. Now, here’s how they stand to lose their shirts and feel like a bride jilted at the altar – as interest rates rise, for example, on the 10-yr bond from 2.85% currently to 3.50%, a 0.65% move, the face value of those $6.3 trillion become $5.1 trillion.

In other words, we’re three rate hikes away from causing America’s largest lenders from losing $1.2 trillion.

- Central banks themselves own trillions in Treasury notes. They stand to lose trillions as well and will need to figure out ways to sell them without causing added panic.

The bonds market is so potentially toxic that it might usher in an actual conflict between America and the rest of the world.

Retirees depend on bonds as well. Most pension funds are saturated with Treasuries, and it will be a nightmare for them as well.

Courtesy: Cohen & Steers

Thus, I’ve been adding exposure to REITs, as this type of business is able to generate massive returns, while stocks suffer.

The most attractive aspect of REITs is that they allow us to invest in real estate assets that we couldn’t invest in on our own.

Nursing homes, elderly homes, government buildings, mini-storage complexes, and other niched housing, which is lucrative, can be purchased with one button and avoid the hassles involved with owning real estate.

One of the best ways I see you substantially increasing your income is to build a secondary stream of revenue.

Right now, the U.S. is starting to shift back to home ownership, but many families cannot apply for a mortgage. They’ve saved up enough cash to come up with a down-payment, but banks aren’t willing to originate loans to them, since they have poor credit scores.

I’ve recently seen a close friend of mine close lease options deals, which generate thousands of dollars a month in cash sums to him, on top of monthly fees that last for years, and he has been able to do this, while retaining a full-time job.

This is the perfect strategy for market conditions, such as these – it’s home-based, doesn’t require significant start-up capital, and provides a win-win solution for certain sellers and buyers, which he creates.

I’ve just closed one such deal personally, and I’m putting together a case study, as a Special Report, since it works in every U.S. market, takes a number of hours to put together, if implemented correctly, and banked me a 5-figure sum immediately.

Make it a point to allocate at least $150 a month to your education. Buy books, go to meet-ups, or treat the top real estate agent in your area to coffee. Connections will fuel many ideas and you’ll learn what people are doing right now to generate extra income.

While here in Costa Rica, I’ve met two couples, who take pictures, which they upload to an online photo market, and magazines pay them thousands of dollars a month for usage.

Start right now – make sure you find a secondary income stream.

Continued Reading

PAINTED INTO A CORNER: Dollar S-C-R-E-W-E-D Badly!This is the closest we've come to a pivotal moment for the global economy since …

PAINTED INTO A CORNER: Dollar S-C-R-E-W-E-D Badly!This is the closest we've come to a pivotal moment for the global economy since …

CLEAN SLATE: Trust Me on This!One of my traveling destinations is Cambodia. Many Asian countries are just now opening up …

CLEAN SLATE: Trust Me on This!One of my traveling destinations is Cambodia. Many Asian countries are just now opening up …

WAR IN THE MIDDLE EAST!In the 1980s, Hollywood director Robert Zemeckis was a nobody; though he felt that he …

WAR IN THE MIDDLE EAST!In the 1980s, Hollywood director Robert Zemeckis was a nobody; though he felt that he …