Stock Market Wealth

Become A Wealth Machine

IN THE BLAST RADIUS: Stocks Implosion – IMPENDING DANGER!

There you have it; the World Economic Forum is meeting in Davos and all the billionaire investors and hedge fund managers are talking about is the fact that the Federal Reserve is behind the MARKET’S PARABOLIC surge.

The commentary coming out of there is textbook Wealth Research Group material. I want to show you today why the real question you must be asking yourself is whether you’re a LONG-TERM investor, viewing the world like Warren Buffett does, or if you’re a trader, viewing it like billionaire investor Paul Tudor Jones.

The reason I say this is because if you’re an investor, your options are truly limited, few and far between and offer little in the way of extraordinary compounding opportunities, at the moment.

Buffett isn’t sitting on $128B in cash because he has liquidated his portfolio; a long-term investor will NEVER sell equities or ownership stakes in great businesses, bought at good prices, simply because markets are due for a big shakeout.

The way he accumulated this cash position was simply by shying away from making new allocations, whenever profits came in and piled on. I’ve done something similar and now I’ve stuffed the equivalent of 40% of my stock portfolio into the brokerage account as cash.

For every $3 that is invested, $2 is on the sidelines, as liquid cash.

The difference between Berkshire Hathaway’s famed mega-billionaire investor and myself is that I’m also diversifying out of long-term dividend plays and into precious metals, private lending, small-cap stocks and real estate.

The reason is that NO ONE has any idea for how long the Federal Reserve and the other top central banks will continue to POUR trillions of dollars in liquidity into markets.

Courtesy: Zerohedge.com

As you can see, the smart money’s holdings represent a HUGE paradox. On the one hand, they are certain the markets are in a bubble, GROSSLY overpriced, compared with fundamentals. On the other hand, as David Tepper, the billionaire hedge fund mogul and owner of the Carolina Panthers says: “I like riding horses, when they’re running.”

The lesson is clear: IF there’s a bubble – BUT there’s also enough time to jump off the train and not take part of the collision – then 2020 is a time to make SENSATIONAL returns.

In the chart above, you can see that highly experienced investors are betting that the FED will not let the economy contract, if they can help it. They will intervene in the Repurchase Operations (Repo), pump liquidity via QE4 and let inflation run hot, if the consumer gets stronger.

Officially and unequivocally, we are investing in a U.S. stock market that is overly bullish, where investors are buying stocks out of a lack of alternatives, where profits signal that corporations can’t extract more earnings (for the time being), and where leverage is already at a record.

The billionaires’ bet is that there is still a 30%-40% return to be made before the peak is reached. Therefore, you need to be asking yourself if you are IN OR OUT and how much you will be risking.

Take a look at this beautiful chart:

Courtesy: Zerohedge.com

The uptrend is CERTAINLY in place!

As you can see, in 2011, the last mania for gold, the price was 2.3 times above the trend-line support. To replicate that, the price will have to reach $2,750/ounce.

There’s so much more TORQUE to this move and the Davos billionaires are UNUSUALLY bullish. Ray Dalio’s firm leads the bull camp, with Paul Tudor Jones, Guggenheim Fund LONG silver, David Einhorn and Stanley Druckenmiller, among the gold crowd.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

The CHIEF reason that they’re now forecasting a breakout into the $1,800’s and above is that they BELIEVE central banks have been cornered into never tightening again.

After the 2013 tantrum and the December 2018 one-month bear market, the verdict is out: Jerome Powell has WEASELED OUT of his promise to normalize rates, and from here on, all the FED can really do is hope the markets don’t become bent out of shape again, forcing more drastic measures.

The FED is like a chef, who’s already poured too much SALT into the soup. Instead of admitting the error, throwing it away and starting anew, he continues experimenting with the recipe, assuring a RECALL.

I have so much more to publish this coming Tuesday on the matter, so I want to present two more important charts that prove that stocks are now, same as other assets, a way to be allocated into anything that isn’t cash.

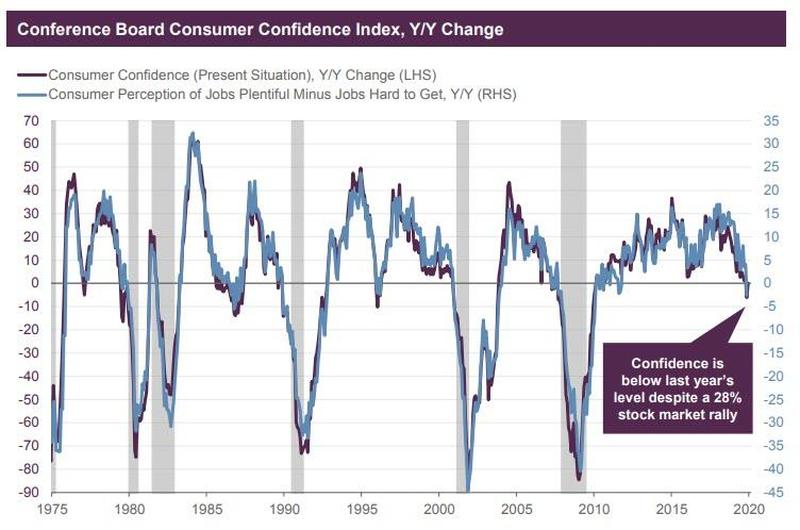

For one, look at the crashing confidence levels of consumers regarding the economy and the jobs market; this is not LOOKING GOOD.

In an economy that is 69%-based on services and consumerism, this is unacceptable.

But it’s not only that; the DISPARITY between valuations and what corporations are worth is HUGE.

Truly, central banks have distorted pricing mechanisms and everyone is in the BLAST RADIUS.

Courtesy: Zerohedge.com

No one in the history of the world has been able to ride a bubble forever. All bubbles POP and this one is no EXCEPTION.

Stocks are units of ownership in companies and profits are the ultimate barometer of the value of businesses.

As David Tepper says, you can ride the horse, while it’s running, but if you’re not sure how to stop a wild horse safely, consider watching this last bit from the stands.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

No matter how good an investment sounds, and no mater who is selling it, make sure you’re dealing with a registered investment professional. Use the free, simple search at investor.gov This work is based on public filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought. Never base any decision off of our advertorials. WealthResearchGroup stock profiles are intended to be stock ideas, NOT recommendations. The ideas we present are high risk and you can lose your entire investment, we are not stock pickers, market timers, investment advisers, and you should not base any investment decision off our website, emails, videos, or anything we publish. Please do your own research before investing. It is crucial that you at least look at current SEC filings and read the latest press releases. Information contained in this profile was extracted from current documents filed with the SEC, the company web site and other publicly available sources deemed reliable. Never base any investment decision from information contained in our website or emails or any or our publications. Our report is not intended to be, nor should it be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell securities, or as a recommendation to purchase anything. This publication may provide the addresses or contain hyperlinks to websites; we disclaim any responsibility for the content of any such other websites. Please use our site as a place to get ideas. Enjoy our videos and news analysis, but never make an investment decision off of anything we say.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

SINISTER Elite AGENDA: Walking On Your GRAVE!You're deliberately being lied to. I can assure you – the agenda is to keep …

SINISTER Elite AGENDA: Walking On Your GRAVE!You're deliberately being lied to. I can assure you – the agenda is to keep …

HEMP STOCK STUNNER: This is How to Play the CBD Buying SpreeToday’s best bets in the legalized cannabis market aren’t what the corporate media has been …

HEMP STOCK STUNNER: This is How to Play the CBD Buying SpreeToday’s best bets in the legalized cannabis market aren’t what the corporate media has been …

KNEELING DOWN: Powell Follows Strict Rothschild ORDERS!It looks like 10 years of central banking liquidity infusions that make their portfolios as …

KNEELING DOWN: Powell Follows Strict Rothschild ORDERS!It looks like 10 years of central banking liquidity infusions that make their portfolios as …