Stock Market Wealth

Become A Wealth Machine

THROUGH FLAMING HOOPS: Devour Shorts – SILVER LETS FLY!

The markets WANT UP. We got our final chance (probably) to LOAD UP on our round 2 list last week and the returns are ALREADY ASTRONOMICAL. Several of the mentioned companies came within range and have BOUNCED HARD. Treat them as either short-term trades or long-term holdings – all of them are up over 10% already!

All of this BUYING MOMENTUM is coming from institutional buyers, which means that we’re turning a corner.

Jerome Powell went through flaming hoops and did his thing on 60 Minutes, sparking a MAJOR CONFIDENCE BOOST.

He sounded patriotic, sympathetic and professional. Most of all, he had an attitude of YOU AIN’T SEEN NOTHING YET.

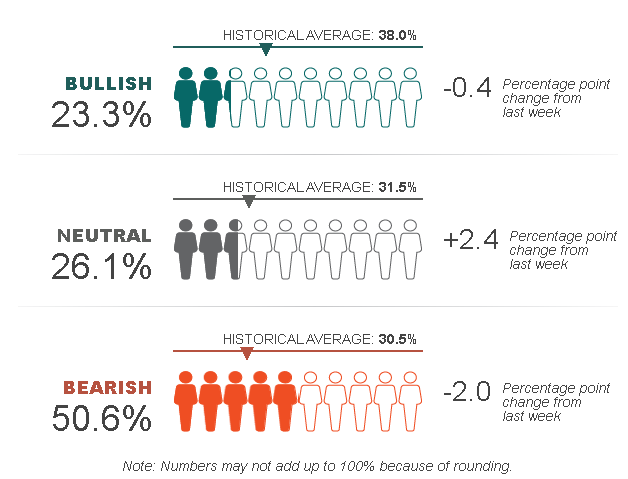

Courtesy: AAII.com

Importantly, up until yesterday, investors were SUPER-BEARISH, which means that the aggressive move higher from the March lows (as we said all along) was done on THIN VOLUME.

It was sort of artificial, but now it is LEGITIMIZING itself with real buying.

It may very well be that if more and more countries are successfully able to re-open, we won’t see MANY MORE corrections, unless some major setback pops on the radar, which doesn’t seem likely (but you never know).

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

KEY ANALYSIS OF THE S&P 500 IN 2020

We compiled CRITICAL DATA about the S&P 500 components to show how much TORQUE there is left, if efforts to re-open DON’T FALL SHORT and are largely successful.

Many stocks are still looking abysmal, so there’s more upside, going forward.

- 100 companies are down anywhere between 27% and 40% THIS YEAR ALONE. It sounds bad and it is bad, but these aren’t the WORST OF THEM.

- 100 additional companies (a fifth of the index, let’s not forget) are still down between 40% and 80%!

The cruise lines are in this group, as well as airlines and mall operators.

- On top of that, 57 companies are down between 20% and 27%, which means that a total of 257 stocks are down more than 20% from January 1st.

In other words, while the S&P 500 index might be EXPENSIVE, there are opportunities within it. Our picks from the exclusive SHOPPING LIST REPORT are up, if entered into below the limit orders in just the PAST FIVE DAYS alone, substantially: AXP +12%, VFC +8.2%, UGI +13.6%, LEG +23.9%, and SWK +20.5%.

Determine, if you indeed CAPITALIZED on any of these, whether you’re going to be BOOKING GAINS or to hold them as long-term positions. The profits from just a few trading sessions are more than the ANNUAL AVERAGES of these companies, so I’m THRILLED we published this report, allowing us to make DOUBLE-DIGITS RETURNS!

Courtesy: Zerohedge.com

As you can see, the Federal Reserve is CONSERVING AMMUNITION, as I said it would, intervening less and less.

All of this is like a signed MJ jersey to a basketball fan – it is FREE MONEY, a dream com true. As capitalists, we don’t mind HEDGING OUR SAVINGS in precious metals and making a fortune, since we have done our homework and know how this system works.

Gold was trading above $1,776, a symbolic figure for Americans, until the markets became so convinced that Covid-19 was behind us that gold began correcting.

Nevertheless, the trend has been SET IN MOTION.

At first, the major-cap miners – those who HAVE THE GOLD – are making huge profits. In fact, out of all of the companies in the S&P 500 this year, Newmont Mining is the BEST PERFORMER, up 56.27% as of this writing. In comparison, the best of the FAAMG stocks is up (AMZN 30.41%), followed by MSFT (16.14%), but the other three are almost flat.

In 2008, once the stimulus began in the fall, it took the juniors six months to KICK INTO HIGH GEAR.

We could see a repeat of this in 2020. The stimulus started in early March, so the junior mining sector could light up by hundreds of percent ONCE PROVOKED, and could begin its mania around September, if not sooner!

The time to position is NOW!

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Disclosure/Disclaimer:

We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. We have been previously compensated by Gold X Mining, for a ninety day marketing budget of three hundred thousand dollars, paid for directly by the company, this agreement has since expired. Our affiliate company, Gold Standard Media received three hundred thousand dollars for a ninety day digital marketing agreement that includes the letter

you’re reading now. We have also purchased shares of the company through a recent private placement. We

currently have one hundred and twenty five thousand warrants at a strike price of two dollars and eighty canadian cents and will not exercise any within four weeks of any email coverage. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEC filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, extracted from SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

Israel’s Prime Minister Assassination: One Costly MistakeOn November 4th 1995, when I was just eleven years old and in the 5th …

Israel’s Prime Minister Assassination: One Costly MistakeOn November 4th 1995, when I was just eleven years old and in the 5th …

Warren Buffet’s Insurance Companies Winning Recipe!Buffett’s safe and value driven strategy for compounding and reinvesting earnings has secured a fortune …

Warren Buffet’s Insurance Companies Winning Recipe!Buffett’s safe and value driven strategy for compounding and reinvesting earnings has secured a fortune …