Stock Market Wealth

Become A Wealth Machine

New Commodities Supercycle Has Begun

Chinese and European economic activities are finally showing signs of strength, and in 2017, any severe corrections should be viewed as opportunities to position more strategically for long-term gains.

Not only have commodities finished 2016 strongly, but the specific outperforms are those that indicate that we’re going to see a new supercycle, and they have flashed a clear buy signal.

Copper, iron ore, and crude oil are all up big since Election Day, and it’s just the temporary “Trump effect” – it’s backed by a lot of indisputable financial data that Wealth Research Group tracks.

Global manufacturing levels are at a 3-year high and are trending higher, mainly because China is looking to grow and expand. We’ve covered the nuclear energy plans, but this is about much more.

Their middle class is absolutely booming, as can be seen by car sales.

The sheer quantity of metals needed to produce so many vehicles is extremely bullish for zinc, which is already under supply pressures.

China isn’t the only confirming indicator that our moment has arrived, either.

The last time so many global factors came together, commodity prices rose by close to 800%, and select mining shares created a new class of millionaires.

Back in ‘03-08, when China was creating infrastructure mega-plans, the last commodity supercycle occurred. Now, it’s China, Europe, and the U.S., together with India, Russia, and many South and Central American countries, all building their foundations for the 21st century at the same time. As you can see, we have plenty of upside.

Oil prices rising, along with the FED raising rates, the newly proposed trade agreements, and the dollar’s decline of 3% since last month are all making inflation expectations higher than in the past 8 years. Commodities are going to impact portfolios, and what I like the most is that we’re positioning correctly so that when major banks point their clients towards small-cap stocks, we will be the strong hands that are holding for much higher bids.

High inflation rates and low interest rates are making high-yield investments close to impossible, and Wealth Research Group profiled 2 companies in 2016 that yield 8.4%, a requirement to be called a High-Yield Master. Both are up double-digits in 3 months, and including dividends, they have already returned close to 18.43% on average.

I spent the past week analyzing 53 companies that yield over 7.2% in dividends and have direct upside potential from commodities, and I found one company to own for the long-term.

This is part of the High-Yield Stocks asset allocation model of the 2017 Global Wealth Portfolio, and if you are approaching retirement, companies like this are extremely rare to find.

These inflationary trends are creating a set-up for gold and silver as well.

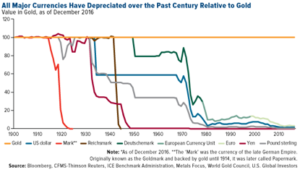

It is already a fact that no fiat currency has held its status this century versus gold, and there is absolutely no reason to expect that any will in the future.

We own physical gold and silver because governments steal our wealth using currency printing. Gold has had a 2% annual increase in production this past century, but currencies have been printed at a much faster pace.

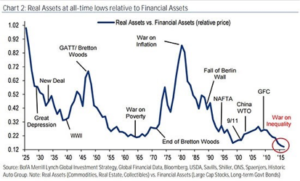

There is absolutely no question that this chart shows the 36-year downtrend in real assets has approached exhaustion, and aligning with higher mineral prices is the most sensible and contrarian move to make, while 99% of investors are still hypnotized and following the old paradigm.

Stay focused on the big picture, and expect this coming cycle to be a record setter.

Continued Reading

Balls-to-the-Wall Gold Breakout TrajectoryOn Wednesday, March 20th, Chairman Jerome Powell took to stage. What he said in his …

Balls-to-the-Wall Gold Breakout TrajectoryOn Wednesday, March 20th, Chairman Jerome Powell took to stage. What he said in his …

Doug Casey on COVID Brainwashing: “Look, Hysteria Is The Problem; Not The Flu Itself”Recently, gold bug and investor Doug Casey sat down with Kenneth Ameduri of Crush the …

Doug Casey on COVID Brainwashing: “Look, Hysteria Is The Problem; Not The Flu Itself”Recently, gold bug and investor Doug Casey sat down with Kenneth Ameduri of Crush the …

RETRIBUTION: INFLATION Says Hello – Markets SEA of RED!I spent the summer in Europe. First, I was in London. Next, I spent time …

RETRIBUTION: INFLATION Says Hello – Markets SEA of RED!I spent the summer in Europe. First, I was in London. Next, I spent time …