Stock Market Wealth

Become A Wealth Machine

FINGER ON THE NUKE BUTTON: One Wrong Move – IT’S OVER!

Biological warfare has been practiced since the days of barbaric tribal war and the conquests of the ancient Greeks and Romans. It’s one of the most ancient forms of lethal strategy to weaken the enemy.

One thing armies used to do was leave a corpse infected with some virus, plague, or disease in the vicinity of the path of opposing troops. This was a way of exposing the unsuspecting enemy to lethal biological diseases.

When travelling to New Zealand this past November, my mother-in-law left a green apple in her purse while going through security. She bought it in Hong Kong on the way over and had forgotten all about it. The authorities slapped her (which means me) with a NZD$400 fine. Since their North Island is isolated, bringing anything from other regions is considered hazardous and even dangerous (apples included).

New Zealand understands that for a closed system to function properly, external threats must be addressed, as well as internal, domestic ones. One sick chicken that escapes an enclosed compound can inflict damage to countless other farms; the ensuing fallout would be grave.

Capitalism is a closed system as well, and right now, especially in the United States of America (capitalism’s posterchild), there are many domestic threats that are the equivalent of biological warfare jeopardizing 250 years of growth and prosperity.

For an army to march forward, for an island to remain healthy, for a corporation to stay profitable – for anything to run efficiently, the less friction there is among members, the better.

That concept seems to have been lost on America in the past 30 years. I want to make sure you understand the gravity of the situation, because the finger is on the financial nuclear launch button and any lapse in judgment will bring apocalyptic results, economically and socially.

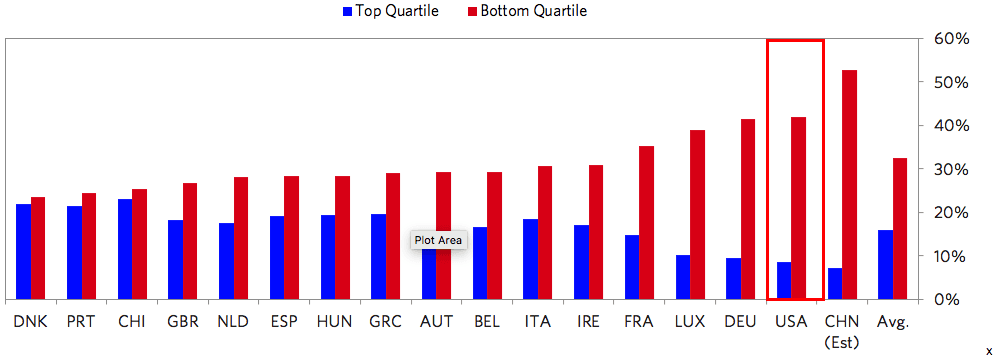

Courtesy: EcomomicPrinciples.org

The rich are certainly BENEFITING from the current form of Capitalism that the U.S. is running on. Globalism has placed in a shrine profits at all costs, so CEOs and upper management executives that are able to generate results – even with negative social costs for domestic personnel by outsourcing – have seen their compensation skyrocket.

Outsourcing successfully, relocating to slave labor regions, automatizing, cutting costs, and investing in share buybacks creates hugely successful entities, but leaves the desert of employees dry.

Nike, for example, makes cheaper and more competitively-priced shoes thanks to globalization, but thousands of skilled workers have joined the poverty demographic where local factories have closed for good and hundreds of thousands of workers in the world’s poorest countries are laboring under atrocious conditions, on the flip side. No law, regulation, or government incentives have been put in place to make sure these Americans that get sacked have a plan B, retraining program, or viable alternative or that the corporations, which leave a trail of damage through America’s heart belt, pay compensation.

For decades, the free market was able to provide displaced workers with alternatives in the boom years – government intervention or not – but this globalization process, along with the past 10 years of central bank intervention, has brought about a situation in which capitalism WORKS like a charm, but only for 10% of Americans. Out of that, it works most predominantly for only the top 1%.

For them, there is little incentive to change the current wheel of fortune that puts them in a financial condition of luxurious living, with 100% upside and no clear downside.

But for the 1st time, they (the ultra-wealthy) see the symbolic dead corpse in the middle of their rich camp – it is populism, intolerance towards their success – and they’re right.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

More and more Americans don’t understand how there is so much money in the world, yet they can’t scrape together $400 to fund a medical emergency. They can’t figure out how people drive around in a new Mercedes-Benz every year, while they take the bus, no matter how hard they work or how skilled they happen to be. They are astonished to see shares of Starbucks hit all-time highs, while they make 20 lattes an hour standing up, earning minimum wage, with no clear path ahead for their own careers.

It is beyond them how Amazon’s founder is worth over $120B alone, while they can’t afford to order a new toy for their kid.

Right or not, the masses are angry and frustrated.

Courtesy: EconomicPrinciples.org

The poor believe the rich are connected and corrupt, while the wealthy assume all low-income individuals are downright lazy. As you can see, 50% of Millennials earn less than their parents did.

None of these generalizations are 100% correct. What is worse, they perpetuate the problem, by not allowing for open dialogue.

The difference between the haves and the have-nots is like ice and boiling water, and societies that function this way always end up with scars and burn marks.

If the central banks keep pumping credit into the banking system, sending it to the top 1%ers, the situation will only worsen. If socialists take over the political thrown, the rich will be treated with aggressiveness, and they’ll be forced to consider fleeing to capitalistic regions where their skills are respected.

Capitalists are not experts at including the general population in their success. You can see this clearly from the fact that Buffett has chosen to wait until he is dead to donate his fortune instead of letting it do good now. They don’t see how philanthropy can work with a high ROI rate.

Government officials don’t understand that teaching a man to fish is better than giving him a fish. They give the poor just enough to survive, but not enough to break and exit the cycle.

Courtesy: EconomicPrinciples.org

People born to poor families find it next to impossible to escape the clutches of their environment.

When you have capital, the world of investments is open to you. There is so much in the world that $10 trillion of negative-yielding bonds is out there. Instead of that, these bonds could be converted into study books, for example, and handed out to those who can prove they have the motivation to rise up in the world. They could pay their costs back (the principle) and interest (better than zero rates) when they get their 1st paycheck.

The poor need opportunities and the rich need to understand that the system that has made them this way will not be the one that keeps them this way.

We are on the precipice of either a quantum leap forward or a major retraction. The verdict is not out yet, but these are trying times.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

BUCKLE-UP: Silver Warming-Up!On Wednesday and on Thursday, we saw record up-days with the major indices. It's not …

BUCKLE-UP: Silver Warming-Up!On Wednesday and on Thursday, we saw record up-days with the major indices. It's not …

WHAT A WASTE!Most people never dig deep into their internal worlds.

WHAT A WASTE!Most people never dig deep into their internal worlds.

WE’RE BEING SET UP: Harley Schlanger Tells Hard Truths about What’s Coming in the Stock MarketWorld governments and central banks are known for being bad actors: you might not hear …

WE’RE BEING SET UP: Harley Schlanger Tells Hard Truths about What’s Coming in the Stock MarketWorld governments and central banks are known for being bad actors: you might not hear …