Stock Market Wealth

Become A Wealth Machine

Investors are Betting on E-Scooters and Micromobilty in the RideShare Economy

This is a guest contributor article.

Overnight, an infestation descended on city streets. It was a swarm. What was once a benign child’s toy suddenly became a civic scourge.

Overnight, an infestation descended on city streets. It was a swarm. What was once a benign child’s toy suddenly became a civic scourge.

Or, if you happened to likeriding one of these electric scooters — which is basically a skateboard with handlebars — you see them as an incredibly affordable, green, fun-to-ride mode of convenient transportation.

E-Scooters have arrived. En masse. Whether you love them or hate them, some 65 cities worldwide find themselves suddenly having to deal with them.

Electric scooters cost as little as $195 for a rudimentary model at Costco, and can weigh between 25–40 pounds. They reach speeds of about 15 mph — fast enough to get a rider from their home to public transit, or from public transit to work (what is considered “last mile” transportation).

They’re one part of a bigger picture called “micromobility,” and it’s one of the hottest investment opportunities on the street today.

New Millionaires are Being Created from This Megatrend

Micromobility’s addressable market in the US is valued as high as $1.4 trillion annually.[1] This may appear like an astronomically high number, but it seems completely reasonable when you consider that almost half of all vehicle trips in the United States are under three miles.[2]

New companies, who are producing micro-transportation devices, have rolled out at an electrifying clip in cities across the world — and they continue to create new millionaires almost by the minute.

In 2017, investors plunged $2.8 billion into bike sharing start-ups, up from $343 million the prior year, according to CB Insights.[3]

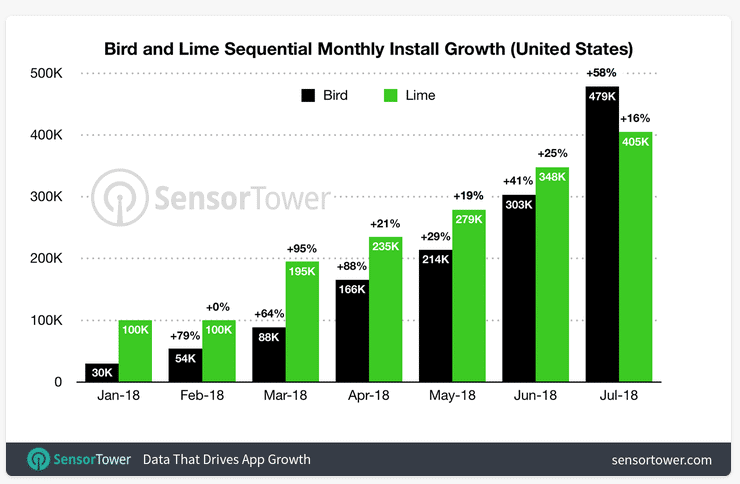

Segment leader startup Bird raised $400 million last year, and skyrocketed to an astounding $2 billion valuation.[4] Bird rose to unicorn status faster than any other startup in history, notching this $2 billion price tag in less than a year!

To put that into perspective: Airbnb took nearly three years to reach a $1 billion valuation — and Uber needed four. It appears that the world is ready for micromobility solutions like never before.

This record-breaking growth is driven, in part, by increasing consumer demand. According to Micromobility Industries, shared scooters and dockless bikes have attracted nearly 500 million users in barely three years, making micromobility the fastest technological adoption in history.[5]

Following in the footsteps of Bird, their major competitor Lime, only eighteen months into operations, raised an equally stunning $382 million from investors and climbed to a valuation of $1.28 billion.[6] This demonstrates there is room for more than one winner in the space — and those who win…win big!

And it looks like this is much more than a fad. The MaaS (mobility-as-a-service) market is expected to grow to approximately $9.5 trillion by 2030.[7] Yes — you read that right. This massive upward trend, locked into a groove now, owes major thanks to technical advancements in equipment, including more efficient electric drive trains.

Car Sharing to be Overtaken by Scooter Sharing

Sales of electric-powered micro-transport have continued to climb year-over-year. URB-E, a foldable, electric scooter company based out of California, has sold thousands of foldable electric scooters to consumers since 2015. The company’s scooters range in price from $900 to $2,000.

There was also an enormous transaction that was just announced related to foldable e-scooters with a Hollywood celebrity, but more on that later…

Along with scooters, people are piling onto the earlier-introduced, e-bicycle bandwagon.

The Economist reports that, “In Germany, 15% of new bikes sold in 2016 were electric, with sales up by 13% and exports by 66% compared with 2015. Belgium and France are big markets too. Whereas exports of regular bikes from China, Taiwan and Vietnam to the European Union fell by 15% between 2014 and 2016, e-bike exports more than doubled.”[8]

Forward thinking businesses are also joining the ride. One of Germany’s largest electric fleets is owned by Deutsche Post DHL (FRA: DPW / OTC: DPSGY), a logistics giant, and includes around 12,000 e-bikes.[9]

But there’s more to the phenomenal success of the Birds and Limes of the world than just electric micro-transport. The real nitro in the mix of explosive growth, and the second major trend driving this train, should be pretty obvious — Ride Sharing.

Arguably, the hottest new segment of the RideShare market, an emerging mode that goes beyond the Lime and Bird electrified scooter model, are “real” scooters, the kind you sit on — think electric Vespas — that have begun to turn up in cities around the world.

This type of scooter sharing has boomed since 2015, and programs can be found in 30 cities around the world — primarily in Europe.[10]

In fact, 2017 saw a quadrupling of the number of scooters deployed. According to research firm InnoZ, “The floating car-sharing market might be overtaken by the scooter-sharing market in [the] future; ([its] large potential being mainly due to lower capital investment needs and the benefits of needing less time to find a suitable parking space).”

There are other benefits that tip the scales in favor of e-scooters, too. According to a recent Wired article, “…the cost of fueling an e-scooter is a little more than 1% of the cost of fueling even a car that delivers a respectable 28 miles per gallon.”[11] It really is a greener alternative.

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

RideShare Economy Set to Fly Higher

What’s the growth potential of micromobility? Look to the sky — you’ll spot a high-flying Bird I’m sure.

“Bird might be the fastest-growing company ever,” says Mark Suster, the managing partner of Upfront Ventures, which invested in each funding round.[12]

Suster even suggests that Bird “…could be the fastest-growing company to a billion-dollar run rate in history.”[13] In June, Bird’s run rate was $65 million and 4 months later it increased to $100 million… just 14 months after its launch.[14]

The Next Big Thing in Micromobility

Check this out… Full-scale scooters (real Vespa-like) are used primarily in Europe and Asia, meaning that the North American market remains pretty much wide open. That amounts to a major blue-sky opportunity for an emerging company called LOOPShare (TSX-V: LOOP/ OTC: LPPPF).

LOOP skyrocketed onto investor screens in January with the surprise announcement that the company had gone into business with American TV personality, music star, and successful tech entrepreneur Ray J and his company, Raytroniks.

LOOP skyrocketed onto investor screens in January with the surprise announcement that the company had gone into business with American TV personality, music star, and successful tech entrepreneur Ray J and his company, Raytroniks.

According to the LOOP news release: “Raytroniks was formed to offer a new wave of electronic transportation, providing an eco-friendly, efficient and convenient mode of transportation customized with the unique designs and features of the Scoot-E brand; a vision which directly aligns with LOOP’s core scooter-sharing business model.”

Celebrity Influence — The Ray J Factor

A-list celebrities and athletes like Sean “Diddy” Combs, Drake, Cara Delevingne, Justin Bieber, Steph Curry and Snoop Dogg have all been seen riding and enjoying their Scoot-E-Bikes.[15]

Pictured (clockwise from the top): Drake; Ray J; Justin Bieber; P. Diddy with Ray J, Snoop and The Game; 3-time NBA Champion Steph Curry; and Cara Delevingne.

Working in the entertainment industry for 25 years has helped Ray J build a loyal fanbase, including 1.7 million followers on Instagram. Shares in LOOP shot up 300% when the pending acquisition and partnership deal between Ray J and LOOP was announced, which speaks to the quality of the company and Ray J’s tremendous social influence.[16]

The project has large ambitions. According to TMZ, “LOOPShare and Scoot-E-Bike will aim to take down RideShare giants like Bird with a plan to supply users with three types of scooters to get around town.” Now there’s a headline.

Managing the Herd with Advanced Technology

LOOPShare Ltd. is a global leader in micromobility telematics technology. Their fully-integrated lightweight electric scooters have a touchscreen dashboard, mobile app and fleet management system, making them exceptionally easy to use and maintain.

As the company looks to expand, they will focus on deploying in urban centers, university campuses, and tourist destinations, among other locations.

LOOP offers a “free floating” service, meaning that a user will be able to collect a scooter and park it anywhere within a given area.

LOOP offers a “free floating” service, meaning that a user will be able to collect a scooter and park it anywhere within a given area.

There is no need to bring the vehicle back to the starting point or to a charging station. The scooters can be located and reserved using the LOOP app, available on your smartphone.

Once a user arrives at the reserved scooter, they can enter the unique PIN code on the 7’’ color touchscreen dashboard and start their trip.

At least one helmet will be stored in the locked box, along with a hygienic disposable head cover. After a user reaches the final destination, they can just park the scooter, return the helmet to the box, log off and walk away.

It’s an Easy Process for Consumers

Using North America as a home base, LOOP plans to deploy into 46 cities internationally over the next five years.

That strategy dovetails with a longer-term megatrend of MaaS (mobility-as-a-service).

Loop plans to integrate Ray J’s brand of Scoot-E bikes into its portfolio of intellectual property and implement these bikes on a broader scale to the masses.

Driven by Five Powerful Megatrends

Those who have followed me over the decades know that I’m all about the trend — especially those underlying, long-term trends where there is potential for massive disruption.

I was there, for example, in the earliest days of the Internet. I wrote and spoke about the potential for massive disruption as early as 1990, and I watched those who paid attention make fortunes.

Today, I can’t help but look at the sea of change in transportation. There are a number of factors that, combined, are fundamentally disrupting how we provide — and how we buy — transportation in a world where the population is projected to grow from seven billion today to eleven billion by the end of this century.

Powerful Megatrend #1: Electrification

The carbon economy is fading into the past. Even hydrocarbon companies such as Shell (NYSE: RDS-A / NYSE: RDS-B) are making adjustments to reduce their carbon footprint — compensating top level management in part by assessing their divisions’ reduction in carbon footprint.

Automakers including Volvo (VOLV-B.ST) globally have also committed billions to electric drivetrains and electric car roll-out programs.[17] Volkswagen (FRA: VOW.F / OTC: VLKAF / XETRA: VOW.DE) announced last year that by 2020 their goal is to “…offer our customers more than 25 new electric models and more than 20 plug-in hybrids … the world’s largest fleet of electric vehicles.”[18]

Powerful Megatrend #2: The Rise of the Sharing Economy

The rise of the sharing economy has already driven fundamental changes already seen in success stories like Uber and Lyft, and various clones worldwide. Both companies have also invested in e-scooter companies.

As they look to expand their e-scooter arm, Lyft just filed for an IPO, where the company is estimated to be valued between $20–25 billion.[19]

Let that sink in for a moment…

These companies’ successes have been driven in no small part by commitments from those who have some of the greatest stakes in transportation — the car manufacturers, a number of whom already own RideShare operations. They’ve started to redefine themselves as mobility services enterprises, rather than car makers.[20]

In 2016, Ford announced the creation of Ford Smart Mobility, a subsidiary dedicated to developing and commercializing mobility services, and investing in mobility-related ventures.

They also acquired Spin, an electric scooter company, for $100 million in November of 2018, and Reuters estimates that they will invest $200 million into the business.[21]

Powerful Megatrend #3: Limitations on Public Infrastructure Spending

There is huge pressure on governments at all levels to contain transportation costs. Building capital-intensive, mass transit infrastructure and roadways can only go so far — a reality easily seen today in the “last mile” gap — connecting public transportation to work and home. That’s a gap that private interests have already shown considerable success at filling.

Powerful Megatrend #4: Reduction in Car Ownership

We know younger generations have a waning appetite for vehicle ownership.[22] Approximately 80% of Americans live in urban areas, according to the US Census Bureau.[23] With parking and living costs becoming increasingly expensive, car ownership just doesn’t make sense for a growing number of city dwellers.

Powerful Megatrend #5: Increase in Urban Population Centers

Last, but not least, it is no secret that cities are becoming more crowded, which puts more pressure on transportation infrastructure and the environment around it. More than 50% of the world’s population, 4 billion to be exact, live in urban areas, and that number is expected to grow to 66% of the population by 2030.[24]

These 5 Megatrends will continue to propel businesses such as Bird, Lime, and new market entrants such as LOOPshare.

Final Call for Boarding

Now is the time to be positioned in mobility services and microtransportation.

Now is the time to be positioned in mobility services and microtransportation.

Integrated transportation companies will have an advantage going forward because they are inherently better-positioned to provide bundled services that meet a broader range of transportation needs.

The thing is this, at the venture-class level of public companies, there just aren’t that many targets around.

This is an opportunity for smart investors to gain exposure to a groundfloor microcap company in a sector that will continue to attract greater levels of attention going forward.

It’s clear that LOOPShare (TSX-V: LOOP/ OTC: LPPPF) could have the potential to leave savvy investors flying high.

As always, conduct your own due diligence before making any investment, take a portfolio approach to balancing risks within your tolerance level, and seek professional, third party advice.

Let’s get LOOPed!

![]()

Blake Desaulniers, Contributor

for Investors News Service

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: LOOPshare (TSX-V: LOOP/ OTC: LPPPF) is a Blake Desaulniers portfolio holding. Shares were purchased in the open market.

Governments Have Amassed ungodly Debt Piles and Have Promised Retirees Unreasonable Amounts of Entitlements, Not In Line with Income Tax Collections. The House of Cards Is Set To Be Worse than 2008! Rising Interest Rates Can Topple The Fiat Monetary Structure, Leaving Investors with Less Than Half of Their Equity Intact!

Protect Yourself Now, By Building A Fully-Hedged Financial Fortress!

Please read our full disclaimer at WealthResearchGroup.com/

Continued Reading

This Scares Me – HUNKER DOWN!I don’t like the level of risk tolerance investors have at the moment – it …

This Scares Me – HUNKER DOWN!I don’t like the level of risk tolerance investors have at the moment – it …

TRUMP’S DAYS ARE NUMBERED: Gold Primed – HERE WE GO!What has happened this past Friday is highly irregular and I can say that we …

TRUMP’S DAYS ARE NUMBERED: Gold Primed – HERE WE GO!What has happened this past Friday is highly irregular and I can say that we …

THERE WILL BE A REVOLUTION: Bob Moriarty’s Stunning Prediction of a Global Battle to Replace Fiat MoneyRevolution is ugly and messy, but it’s sometimes necessary when tyranny exists.

THERE WILL BE A REVOLUTION: Bob Moriarty’s Stunning Prediction of a Global Battle to Replace Fiat MoneyRevolution is ugly and messy, but it’s sometimes necessary when tyranny exists.